The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance. You can see samples of his work at ericbank. Money in the present is worth more than the same amount in the future due to inflation and to earnings from alternative investments that could be made during the intervening time.

Capital Rationing

Cigarette companies have for years looked for the Holy Grail of a smokeless cigarette. Reynolds Tobacco, US maker of Camel and other cigarette brands, launched a smokeless cigarette called Premier. After test marketing it for several months, the company finally recognised that it had created one of the biggest new product flops on record. With brands. But the idea of a smokeless cigarette was still seen by the company as worth pursuing and it began trials on a new smokeless cigarette brand, Eclipse that heats, rather than burns, tobacco. Since the appraial flop, however, the market has changed, with appdaisal smoking becoming a bigger issue. Time will tell whether the Eclipse cigarette brand is launched successfully and generates a positive net present value.

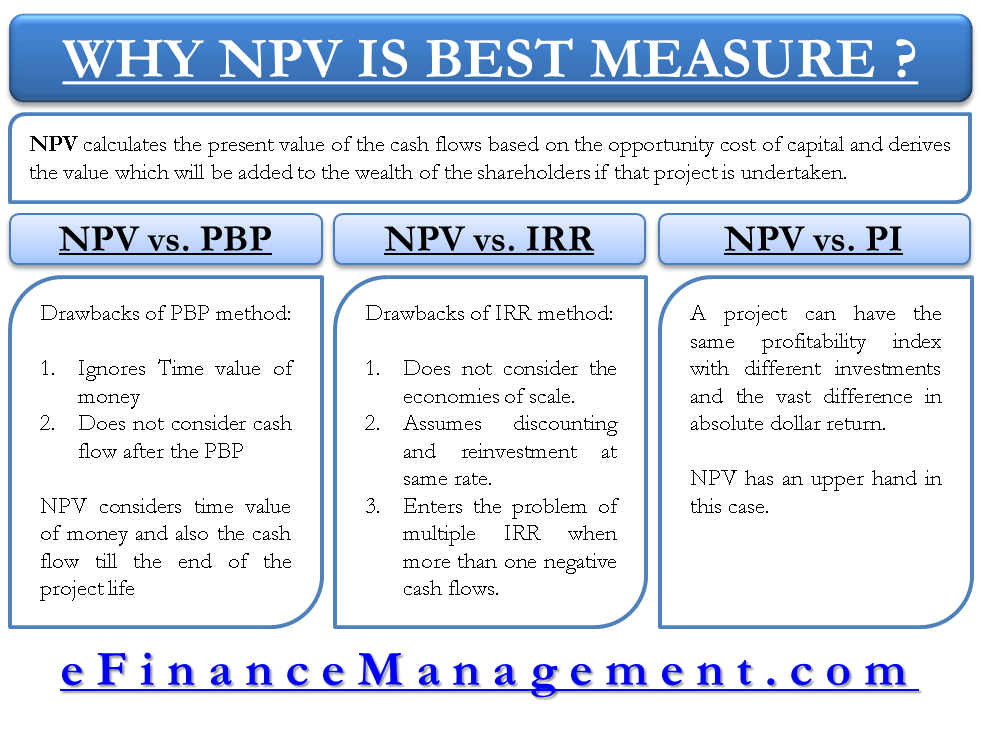

Net Present Value

To grow a company, you must know how much you can spend and where best to spend it. If you run a small business, you realize early that money can be scarce and you must deploy it wisely. You may want to invest in one or more new projects or expansion ideas but have only limited funds to do so. Capital rationing is the constraint on your spending due to limited funds. The net present value, or NPV, investment appraisal method helps you choose which projects to adopt within your constraints.

A level Business Revision — Net Present Value Method of Investment Appraisal

Net Present Value

Cole-Ingait, Paul. Modified Internal Rate of Return — MIRR Definition While the internal rate of return IRR assumes that the cash flows from a project are reinvested at the IRR, the modified internal rate of return MIRR assumes that positive cash flows are reinvested at the firm’s cost of capital, and the initial outlays are financed at the firm’s financing cost. How the Benefit-Cost Ratio Works The benefit-cost ratio is a ratio that attempts to identify the relationship between the cost and benefits of a proposed project. Related Articles. However, because the equipment generates a monthly stream of cash flows, the annual discount rate needs to be turned into a periodic or monthly rate. To grow a company, you must know how much you can spend and where best to spend it. Money in the present is worth more than the same amount in the future due to inflation and to earnings from alternative investments that could be made during the intervening time. Photo Credits Photos. Businesses must observe proper procedures when undertaking long-term investments to ensure the projected payoff is worth the resource allocation. Moreover, the payback period is strictly limited npv method of investment appraisal the amount of time required to earn back initial investment costs. Paul Cole-Ingait is a professional accountant and financial advisor.

Comments

Post a Comment