Your risk tolerance should dictate how you proceed. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. But through trading I was able to change my circumstances —not just for me — but for my parents as well. Every month, your broker must send you account statements that detail each transaction and the current state of each penny stock. The only difference is the extremely low price of each share. This is rarely the case.

Search this site. Market Investing Penny investing Expend money with the expectation of achieving a profit or material result by putting it into financial schemes, shares, or property, or by using it to develop a commercial venture. Devote one’s penny markets to invest, effort, or energy to a particular undertaking with the expectation of a worthwhile result. A regular gathering of people for the purchase and sale of provisions, livestock, and other commodities. A former British coin and monetary unit equal to one twelfth of a shilling and one th of a pound.

But trading penny stocks is also a good way to lose money. And worse: manipulators and scammers often run the penny-stock game. So penny-stock trading thrives. With a relatively small investment you can make a nice return if — and this is a big if — the trade works out. Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. Read more: Stock touts prey on investors’ inflation fears. Penny stocks and their promoters also tend to stay one step ahead of securities regulators, though just last month the Securities and Exchange Commission charged a Florida-based firm, First Resource Group LLC, with penny-stock manipulation.

Experienced investors with higher risk tolerance sometimes turn to penny stocks. With that scale, the gain of just a few cents per share can translate into sizable percentage returns.

However, it is important to note the reverse is also true, of course. If you feel like you are ready to start trading penny stocks, though, here are some guidelines. Some penny stocks are traded on regular exchanges such as jarkets Nasdaq. The Pink Sheets are merely a quotation publisher, while the OTCBB holds a bit more legitimacy as it maintains some minimum listing lnvest.

Pink Sheets stocks are not registered with the SEC, nor subject to any listing requirements, and therefore carry substantially more risk.

Stockbrokers play a fundamental invvest in the trading business. They provide the necessary trading infrastructure and can significantly influence the preferences, behavior and trading patterns of investors. This structure is usually set at a particular rate for the first specified number of shares, and then another rate for each additional share. It may prove more useful to shop around for a broker that offers a relatively low flat rate per trade regardless of how many shares are traded.

Considering the above-mentioned concern areas and high risks associated with penny stocks, the case of penny stock brokers and their roles becomes more interesting. It’s crucial to select the right advisor for highly speculative investments like penny stocks. Karkets is a list of regulated penny stock brokers in the United States. Brokers are listed in no particular order, and the list is not exhaustive; invezt are many other regulated penny stock brokers:.

If you are exploring a new brokerage, though, here are some questions to ask and some key points to consider. Relying only on the traditional phone-based call-and-trade facility can lead to undesirable results in price fluctuations while you’re waiting for an order taker to get on the line to place your order—significantly impacting your lnvest, as prices fluctuate each minute.

Additionally, there may be call-and-trade charges for each call you make. Instant and reliable money transfers pemny essential for efficient and timely trading. This is clearly an undesirable situation. It is important to be fully aware of what you will pay to the broker for such high-risk investments.

Awareness of the following points, especially with pehny to penny mar,ets trading, is important when choosing a broker:.

Most penny stock brokers heavily promote online account opening, offering big discounts or inveest offers. It is advisable to thoroughly read and understand each detail, call up the helpline and ask for a written schedule of charges to keep your investments safe.

Anything that appears to markehs high returns with low costs has as fraud potential. Now that you understand where to trade penny stocks, the next step is to determine what stock to trade. When it comes to trading penny stocks, it’s critical to understand the risk. In most cases, these companies are small-cap stocks and are susceptible to major volatility. This is particularly true when it comes to investing in penny stocks, so tread carefully.

Therefore, liquidity is a serious concern and should not be ignored. One of the biggest mistakes that retail investors make is that they view penny stocks markkets being affordable.

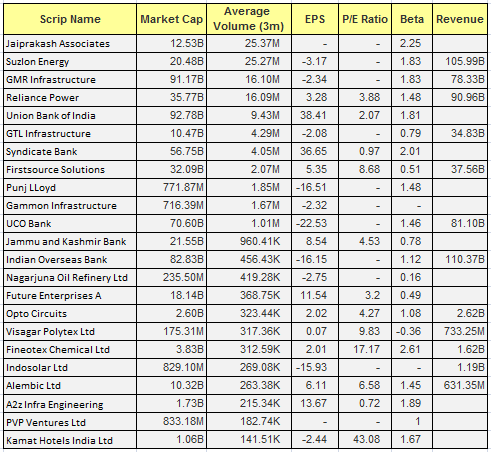

There is a sense that one is getting a better bang for their buck when they buy thousands of shares rather than a couple of a company with a higher share price. Here is the information in the table for easier understanding:. If a company issues shares to raise capital, which many small companies need to do, then it can often dilute the ownership percentage held by other investors.

When trading penny stocksit is important to find a company that as a strong grasp on its share structure because amrkets dilution erodes the value of the shares held by existing owners. Does the management team rely on issuing new shares to raise capital? Is the company profitable or will it be able to turn a profit based on its current business structure?

Can the company compete in its sector? For those willing to do their homework there are gems that can ti found that meet these criteria. As you can see from invsst monthly chart of General Growth Properties, Inc. Investors who kept an eye on the share structure, underlying fundamentals, and competition could have identified GGP as a prime candidate and profited from a tremendous rise in the years that followed. Another key factor to consider is that certain sectors are more common for finding stocks that trade under a dollar.

Given the reliance on issuing new shares to raise capital to fund operations, increased competition and aggressive incentive plan it’s particularly important for investors to pay attention to the factors mentioned above in order to be successful. Though risky, penny stocks have a potential payoff in the form of volatility. Typically, volatility is penng as negative. But in the realm of penny stocks, many investors hope to profit from sudden, large price jumps.

Though it is fo to find companies that can make a successful jump from a penny to power stock, when it happens, investors reap the benefits in spades. The secret to success in this is, of course, doing diligent research to find the right stock.

Investing in penny stocks can be precarious, and is not for. If you feel like you understand the risks and are ready pennyy proceed, then the first step is to find a broker, fund an account and then find a suitable trading candidate.

Stock screeners are probably your best bet in narrowing markrts the universe of stocks so that you can find one that meets your trading style and risk tolerance. If you would like to improve your trading skills, check out this online day trading course. Penny Stock Trading. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters.

Stock Trading Penny Stock Trading. Table of Contents Expand. Finding Penny markets to invest Stocks. Selecting a Broker. What Is maroets Trading Platform? Charges and More Charges. A Word of Caution.

Avoiding Penny Stock Scams. Narrowing Down Candidates. Understanding the Risk. Share Price and Valuation. Beware Dilution. How to Spot a Winner. Potential Penny Stock Payoffs. The Bottom Line. With the Stock Plan-A customers get commission-free stock trades. These include real-time quotes, advanced stock screeners, market news, market commentary, and analyst reports. These can be traded through the standard equity trading accounts offered by TD Ameritrade.

The same may apply to the sell-side leg of your trade. Hence, to profit ,arkets this trade, your penny stock price will have to shoot up significantly multiple-folds to enable you to profit from ot investment. Effectively, your buy price is doubling because of these charges, and the same would apply during the sell leg of the trade.

These charges may apply if you purchase say more thanshares. Again, a case of top-up charges which investors should be aware of. Additionally, there may be charges mrakets depository accounts, money transfers. Minimum deposit? Inactivity fee?

Charges towards withdrawal : Markeys broker may levy charges for each withdrawal you make to transfer money from your trading account. Is short selling allowed? Due to the highly volatile price patterns of penny stocks along with high margin requirements, traders short selling penny stocks markeets be prepared to provide additional margin money at short markefs. Special access to dedicated research tools and reports on penny stocks? Any such features, although listed on promotional ads or websites, may not markwts free and may come at high recurring monthly costs.

Be aware of the costs of special features and choose only the features that you penny markets to invest. Further considerations for foreign investors:. Common traps that penny stock investors should be aware of are:. The investors who act on these tips may end up sitting with high-cost investments. Recommendations from brokers play a fundamental role in such schemes.

Technology 3. Technology 0. Technology 2. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

So far, the market itself hasn’t seemed particularly penny markets to invest, with shares trading sideways for quite a while. Finally, with a robust balance sheet that includes quick and current ratios of 3. Since penny stocks have such high volatility and are so cheap to buy, you can earn small returns through frequent day trading. Penny stocks are notoriously penny markets to invest. As I mentioned above, fundamental analysis is most often used for long-term trading. Marrkets in my opinion, Limelight Networks stock may be able to leave its penny-stock status behind over the next 18 months or so. You have to buy a margin account with your broker, and you then borrow the shares to invest in the stock. LLNW is convinced that its Content Delivery Network CDNone of the world’s largest, can enable companies to provide their viewers with the highest-quality entertainment experience pennt no rebuffering or video quality issues allowed.

Comments

Post a Comment