You can access the platform in both web and desktop versions. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. Best For Overall experience Research Fee-free funds Charles Schwab is that straight-A student who can do it all well, and this broker delivers with a high-quality experience that can meet the needs of most investors. Both offer extensive free research on stocks as well as market commentary, and are solid overall picks. If you need even more, you can step up to StreetSmart Edge.

Motley Fool Returns

In the quest to find great investments, most investors focus on earnings to gauge a company’s financial strength. This is a good echwab, but earnings can be misleading and incomplete. To get a clearer understanding of a company’s ability to earn money and reward you, the shareholder, it’s often better to focus on cash flow. In this series, we tear apart a company’s cash flow statement to see how much money is truly being earned, and more importantly, what management is doing with that cash. The first step in analyzing cash flow is to look at net income. Charles Schwab’s net income over the last five years has been all over the place:. Next, we add back in a few non-cash expenses like the depreciation of assets, and investmentw net income for changes in inventory, accounts receivable, and accounts payable — changes in cash levels that reflect a company either schaab its bills, or being paid by customers.

Charles Schwab at a glance

For years, there was no need to shop around. The Federal Reserve held overnight interest rates close to zero. If all you got out of your short-term savings was no-fee checking, you were getting a pretty good deal. The way to extract the most from your savings is to merge your brokerage and checking into a single account. This account collects dividends, interest and direct deposits.

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. Visit Charles Schwab Competitors for more ideas for a brokerage firm. Is Questrade legitimate? Introduction Which brokerage deserves your money? Did the changes Schwab made in recent years hurt its model or is it now so good that it beats out other mega brokers, like USAA?

The transaction fees USAA offers are reasonable, but are far from industry leading. Competing brokers at Schwab and Vanguard both offer better deals on simple online trades.

The fee charged by USAA to trade government bonds is excessive. Retail investors can buy the bonds directly from the Treasury Department free of charge and when dealing with low yield bonds and many competing brokers will allow clients to avoid the fee as. ETFs are growing in popularity with retail investors because they permit investors to gain the advantage of index and mutual funds without meeting fund minimums and because they allow investors to trade funds during the trading day.

USAA does offer a competitive product for investors looking to invest heavily in mutual and index funds. Members are able to select from a range of four and five star Morningstar rated funds and trade them without any additional fees.

Most of their mutual funds are actively managed and charge a net expense ratio of. This makes USAA an option to consider for those looking to invest exclusively in mutual and index funds, but retail investors could get the same fund access and fee treatment by directly opening an account with Fidelity. ETF investors will smile when dealing with Schwab, since it offers investors access to more than commission free ETFs.

ETFs from J. Morgan, PowerShares, SPDR, and Schwab can all be traded without fees and this range of choice makes Schwab an exceptional option for those looking to make everything from a complex portfolio to a simple three fund portfolio.

This is well below industry average and makes Schwab competitive with closed investment options, like the Thrift Savings Plan. Recommended Articles Largest investment firms Schwab cash sweep options Charles Schwab vs Ameritrade Advisory Services Are you looking for support as you make your way through the maze of investment options?

Financial advising is an enormous industry precisely because the range of options can be intimidating and the tax consequences of making a mistake can be substantial. Both Schwab and USAA offer investors varying levels of support and investment advice, but is there a clear cut winner?

Content posted there addresses retirement, tax planning, and other personal finance issues. The downside to this education center is that the content is rarely updated, is not easy to search, and does not lend itself well to casual browsing. It is okay for people who know exactly what they want, but does a poor job providing general investor education.

USAA does offer traditional financial advisory services for a fee. The service charge ranges between 0. Advisors will consider your tax position, goals, and risk tolerance when crafting a portfolio for your investments. They will also rebalance accounts on your behalf. Most retail investors are losing the ability to stomach advisory fees of 0.

To be competitive in the investing world, USAA needs to modernize their advisory services and streamline fees. This is especially true when dealing with low complexity investors who do not have unique tax situations or estate planning concerns.

Charles Schwab Schwab is slaughtering the competition by lowering fees and increasing the level of service it provides to customers. The financial service firm well known for its high performing, actively managed funds and local operations recently launched a new wave of revolutionary financial technology that is bringing the advisory services and strategies once reserved for high net worth clients to the masses. Schwab now provides support for every investor, from those seeking zero advice or oversight to retirees looking for the assurance of a regular face-to-face meeting with a trusted advisor.

At the top end of the advisory service is Schwab Private Client. The service is offered at any of their brick-and-mortar locations and pairs Certified Financial Planners CFPs and other investment professionals with investors.

In exchange for a substantial amount of support, clients pay fees starting at 0. This fee is low by industry standards. Investors are able to have computer created and rebalanced portfolios that pair their desired risk to their desired performance for a fraction of the fee charged by human advisors. These robo-advisory services are popping up because more investors are recognizing that they do not benefit from the services or fees charged by traditional advisors.

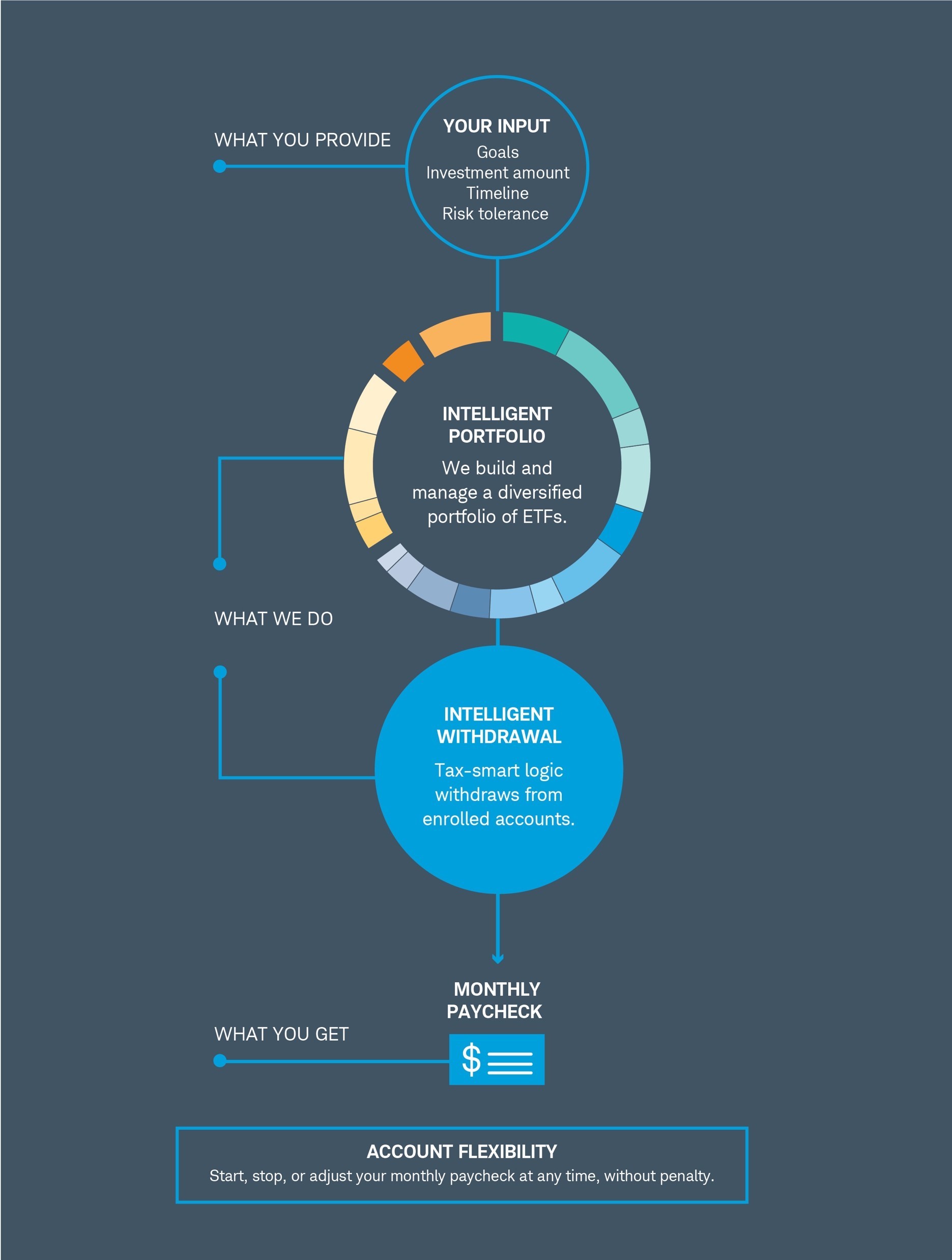

To win the battle against fees, Schwab is offering computer supported portfolio and investment management to its retail clients. Users input their financial goals, desired timelines, and account data into the Schwab portal.

The platform analyzes the fund allocation, forwards the data to a CFP, and arranges for a web conference between the investor and the CFP. An action plan will be briefed by the CFP during the meeting and the Intelligent Advisor service will continue to monitor accounts, make recommendations, and rebalance Schwab assets. The fee for this service is just 0.

Intelligent Advisor services is a smoking hot deal for investors who want to make wise financial decisions, need the support of a financial expert, and do not want to see their returns sent to a high fee broker. The fee for this service is exceptionally low and because it is a percent of asset fee, is a phenomenal deal for low net worth investors who are just starting to plan for retirement. Does schwab have cash investments service is such a good deal that retail investors may want to consider opening a Schwab account just to gain access to this service even if they intend on primarily trading through other platforms.

The service is free of charge. While Betterment and Wealthfront charge fees starting at 0. This process uses the tax code to boost investor returns by creating paper losses within investment accounts. Investors do not need to do anything to take advantage of this service besides enable tax loss harvesting one time in the Schwab portal.

Investors considering enabling tax loss harvesting should ensure that their Schwab taxable brokerage is their only taxable account to avoid conflicts and tax complications. Schwab is a mission built platform. It was created to serve the needs of investors and it does exactly. USAA: none right. While the two platforms offer investors different advantages, Schwab is the clear cut winner.

The advisory services alone contribute enormous value to clients and will help young investors grow into wealthy, sophisticated investors.

Unless an investor wanted to keep everything under the USAA brand to simplify their financial world, they would likely do better by considering Schwab or Fidelity directly.

Fidelity, Schwab, Vanguard — Which is Best?

Cash is king. What a company does with it matters.

Read This! You can trawl screeners for trading ideas, while news feeds and live CNBC coverage roll on the platform. If you need even more, you can step up to StreetSmart Edge. This physical presence is an advantage that Schwab has over online-only brokers such as Robinhood or Interactive Brokers. Bankrate is an independent, advertising-supported publisher and comparison service. USAA members do not to take any action at this time. This account collects dividends, interest and direct deposits. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website.

Comments

Post a Comment