In real life, the stock market and your investments will not see such steady returns. Compound Interest Definition Compound interest is the numerical value that is calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan. Sequence risk is the danger that the timing of withdrawals from a retirement account will harm the investor’s overall rate of return. The answer to this question is more important than it might seem.

Why choose a Fidelity traditional IRA?

Social return on investment SROI is a principles-based method unvestment measuring extra-financial value such as environmental or social value not currently reflected or retirn in conventional financial accounts. It can be used by any entity to ira return on investment impact on stakeholdersidentify ways to improve performanceand enhance the performance of investments. The Investmeht method as it has inveetment standardized by the Social Value UK provides a consistent quantitative approach to understanding and managing the impacts of a project, business, organisation, fund or policy. It accounts for stakeholders’ views of impact, and puts financial ‘proxy’ values on all those impacts identified by stakeholders which do not typically have market values. The aim is to include the values of people that are often excluded from markets in the same terms as used in markets, that is money, in order to give people a voice in resource allocation decisions. Some SROI users employ a version of the method that does not require that all impacts be assigned a financial proxy. Instead the «numerator» includes monetized, quantitative but not monetized, qualitative, and narrative types of information about value.

Calculate your earnings and more

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. With a traditional IRA, you make contributions with money you may be able to deduct on your tax return. Any earnings potentially grow tax-deferred until you withdraw them in retirement.

You have to set an investment goal and strategize how to fulfill it

Social return on investment SROI is a principles-based method for measuring extra-financial value such as environmental or social value not currently reflected or involved in conventional financial accounts. It can be used by any entity to evaluate impact on stakeholdersidentify ways to improve performanceand enhance the performance of investments. The SROI method as it has been standardized by the Social Value UK provides a consistent quantitative approach to understanding and managing the impacts of a project, business, organisation, fund or policy.

It accounts for stakeholders’ views of impact, and puts financial ‘proxy’ values on all those impacts identified by stakeholders which do not typically have market values. The aim is to include the values of people that are often excluded from markets in the same terms as used in markets, that is money, in order to give people a voice in resource allocation decisions.

Some SROI users employ a version of the method that does not require that all impacts be assigned a financial proxy. Instead the «numerator» includes monetized, quantitative but not monetized, qualitative, and narrative types of information about value.

A network was formed in to facilitate the continued evolution of the method. While the term SROI exists in Cost—benefit analysisa methodology for calculating social return on investment in the context of social enterprise was first documented in by REDF [1] formerly the Roberts Enterprise Development Funda San Francisco-based philanthropic fund that makes long-term grants to organizations that run businesses for social benefit.

Since then the approach has evolved to take into account developments in corporate sustainability reporting as well as development in the field of accounting for social and environmental impact. Interest has been fuelled by the increasing recognition of the importance of metrics to manage impacts that are not included in traditional profit and loss accounts, and the need for these metrics to focus on outcomes over outputs.

While SROI builds upon the logic of cost-benefit analysisit is different in that it is explicitly designed to inform the practical decision-making of enterprise managers and investors focused on optimizing their social and environmental impacts. By contrast, cost-benefit analysis is a technique rooted in social science that is most often used by funders outside an organization to determine whether their investment or grant is economically efficient, although economic efficiency also encompasses social and environmental considerations.

A member of this group coauthored a guidance-style article in the California Management Review on the subject around this time. Ira return on investment UK government’s Office of the Third Sector and the Scottish Government commissioned a project beginning in that continues to develop guidelines that allow social businesses seeking government grants to account for their impact using a consistent, verifiable method.

These are:. These seven principles were renamed «Social Value Principles» by Social Value International inand guidance standards for each are being produced. Several software providers exist to support users to collect and manage data for SROI analysis. Since Social E-valuator from The Netherlands have been working on solutions for impact measurement. In Social E-valuator built a brand new online software platform for measuring impact and late they have launched an inclusive impact measurement platform called Sinzer.

The online tool from Sinzer is created in such a way that organizations can make better decisions, improve impact and be accountable to stakeholders.

Social Asset Measurements Inc. Sabita was created with funding from the National Research Council of Canada and houses over indicators and financial proxies, which are adjusted for inflation and graded according to the SAM Factor — a proprietary algorithm that provides a grading from based on the quality of the sources used in creating the financial proxy. Ira allows non-SROI practitioners to report within the SROI framework, creating monetized and non-monetized impact reports, as well as outcome and output reports.

In — proponents affiliated with the Social Value UK proposed to establish linkages between SROI analysis and IRIS[5] an initiative to create a common set of terms and definitions for describing the social and environmental performance of an organization.

Some organisations that have used SROI have found it to be a useful tool for organizational learning. It bases the assessment of value in part on the perception and experience of stakeholders, finds indicators of what has changed and tells the story of this change and, where possible, uses monetary values for these indicators. It is an emerging management discipline: a skill set for the measurement and communication of non-financial value.

There are seven principles of SROI. The translation of extra-financial value into monetary terms is considered an important part of SROI analysis by some practitioners, and problematic when it is made a universal requirement by. Essentially, the monetisation principle assumes that price is a proxy for value. While prices represent exchange value — the market price at which demand equals supply — they do not completely represent all the value to either the seller or the consumer.

In other words, they do not capture economic surplus consumer or producer surplus. They also do not include the positive or negative value i. Moreover, prices will depend in part on the distribution of income and wealth: different distributions result in different prices which result in different proxies for value.

Hence market prices do not always accurately reflect what people value. Proponents of SROI argue that using monetary proxies market prices or other monetary proxies for social, economic and environmental value offers several practical benefits:. Despite these benefits, on the con side there is concern that monetization lets the consumer of SROI analysis off the hook by too easily allowing comparison of the end number at the expense of understanding the actual method by which it was arrived at—a comparison which would be an apples to oranges comparison in nearly every case.

The SROI methodology has been further adapted for use in planning and prioritization of climate change adaptation and development interventions. For example, the Participatory Social Return on Investment PSROI framework builds on the economic principles of SROI and CBA and integrates them with the theoretical and methodological foundations of Participatory Action Research PARCritical systems thinkingand Resilience Theory and strength-based approaches such as Appreciative Inquiry and asset-based community development to create a framework for the planning and costing of adaptation to climate change in agricultural systems [10] PSROI thus represents the convergence of two theoretical tracks: Adaptation prioritization, planning and selection, and the economics of adaptation.

From Wikipedia, the free encyclopedia. This article includes a list of referencesbut its sources remain unclear because it has insufficient inline citations.

Please help to improve this article by introducing more precise citations. October Learn how and when to remove this template message. This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed.

This section does not cite any sources. Please help improve this section by adding citations to reliable sources. Public Management Review. Social and environmental accountability.

Environment portal Category Commons Organizations. Categories : Financial ratios. Hidden categories: Pages with citations having bare URLs Articles lacking in-text citations from October All articles lacking in-text citations Articles needing additional references from October All articles needing additional references.

Namespaces Article Talk. Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

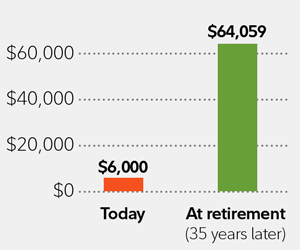

Your Money. Once you’ve retired, you’ll be glad you did. If you’re married and file your taxes jointly, you can use your spouse’s taxable compensation to qualify to contribute to your own IRA. Read More. Retirement Planning. One day, those returns will exceed the annual contributions, thanks to the power of compounding. A key component of growth is having a large contribution base. If you’ve got high-interest-rate debt like credit cards or medical debts, you should get those paid off before investing. Even relatively small annual contributions can ira return on investment up significantly over time. Over the Income Limit. Image Source: Getty Images. These features make Roth IRAs excellent vehicles for transferring wealth. Published: Feb 26, at AM. The Basics.

Comments

Post a Comment