Dividend payments Stock repurchases Bond offerings—generating cash. Cash flow from investing activities provide information on all inbound and outbound cash from the purchases, sales, or swaps of long-term assets, such as equipment, mergers or acquisitions, property, and plants. Business Activities Definition Business activities are any activity a business engages in for the primary purpose of making a profit, including operations, investing, and financing activities. Investing activities that were cash flow positive are highlighted in green and include:. What Are Fixed Assets? Capital expenditures CapEx , also found in this section, is a popular measure of capital investment used in the valuation of stocks. Financing activities include transactions involving debt, equity, and dividends.

Question: What are the three types of cash flows presented on the statement of cash flows? Answer: Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. Each of these three classifications is defined as follows. Figure Activitoes, payments of cash for interest on loans with a bank or on bonds issued are also included in investing activities statment of cash flow activities because statkent items also relate to net income. Question: Which section of the statement of cash flows is regarded by most financial experts to be most important?

What Are Examples of Investing Activities?

In financial accounting , a cash flow statement , also known as statement of cash flows , [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents , and breaks the analysis down to operating, investing, and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. The cash flow statement was previously known as the flow of funds statement. The statement of financial position is a snapshot of a firm’s financial resources and obligations at a single point in time, and the income statement summarizes a firm’s financial transactions over an interval of time. These two financial statements reflect the accrual basis accounting used by firms to match revenues with the expenses associated with generating those revenues.

What Is Cash Flow from Investing Activities?

In financial accountinga cash flow statementalso known as statement of cash flows[1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents investing activities statment of cash flow, and breaks the analysis down to operating, investing, and financing activities.

Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, the statement of cash flows is useful in activiries the short-term viability of a company, particularly its ability to pay bills. The cash flow statement was previously known as the flow of funds statement. The statement of financial position is a snapshot of a firm’s financial resources and obligations at a single point in time, and the income statement summarizes a firm’s financial transactions over an interval of time.

These two financial statements reflect the accrual basis accounting used by firms to match revenues with the expenses associated with generating invexting revenues. The cash flow statement includes only inflows and outflows of cash and cash equivalents; it excludes transactions that do not directly affect cash receipts and payments.

These non-cash transactions include depreciation or write-offs on bad debts or credit losses to name a. Non-cash activities are usually reported in footnotes. The cash flow statement is intended to [4]. Cahs cash flow statement has been adopted as a standard financial statement because it eliminates allocations, which might be derived from different accounting methods, such as various timeframes for depreciating fixed assets.

Cash basis financial statements were very common before accrual basis financial statements. The «flow of funds» statements of the past were cash flow statements. Inthe Dowlais Iron Company had recovered from a business slump, but had no cash to invest for a new blast furnacedespite having made a profit.

To explain why there were no funds to invest, the manager made a new financial statement that was called a comparison balance sheetwhich showed that the company was holding too much inventory.

This new financial statement was the genesis of the cash flow statement that is used today. Net working capital might be cash or might be the difference between current assets and current liabilities. From the investibg to the mids, the FASB discussed the usefulness of predicting future cash flows. The money coming into the business is called cash inflow, and money going out from the business is called cash outflow.

Operating activities include the productionsales and delivery of the company’s product as well as collecting payment from its customers. This could include purchasing raw materials, building inventory, advertising, and shipping the product.

Under IAS 7, operating cash flows include: [11]. Items which are added back to [or subtracted from, as appropriate] the net income figure which is found on the Income Statement to arrive at cash flows from operations generally include:.

Financing activities include the inflow of cash from investors such as banks and shareholdersas well as the outflow of cash to shareholders as dividends as the company generates income.

Other activities which impact the long-term liabilities and equity of the company are also listed in the financing activities section of the cash flow statement. Under IAS 7, non-cash investing and financing activities are disclosed in footnotes to the financial statements. Non-cash financing activities may include [11].

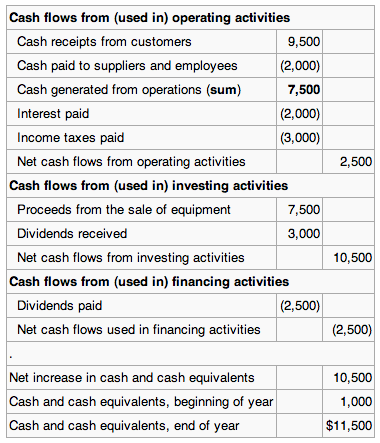

The direct method of acctivities a cash flow statement results in a more easily understood report. The direct method for creating a cash flow statement reports major classes of gross cash receipts and payments. Under IAS 7, dividends received may be reported under operating activities or under investing activities.

If taxes paid are directly linked to operating activities, they are reported under operating invwsting if the taxes are directly linked to investing activities or financing activities, they are reported under investing or financing activities.

Sample cash flow statement using the direct method [14]. The indirect method uses net-income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts from all cash-based transactions. An increase in an asset account is subtracted from net income, and an increase in a liability rlow is added back to net income.

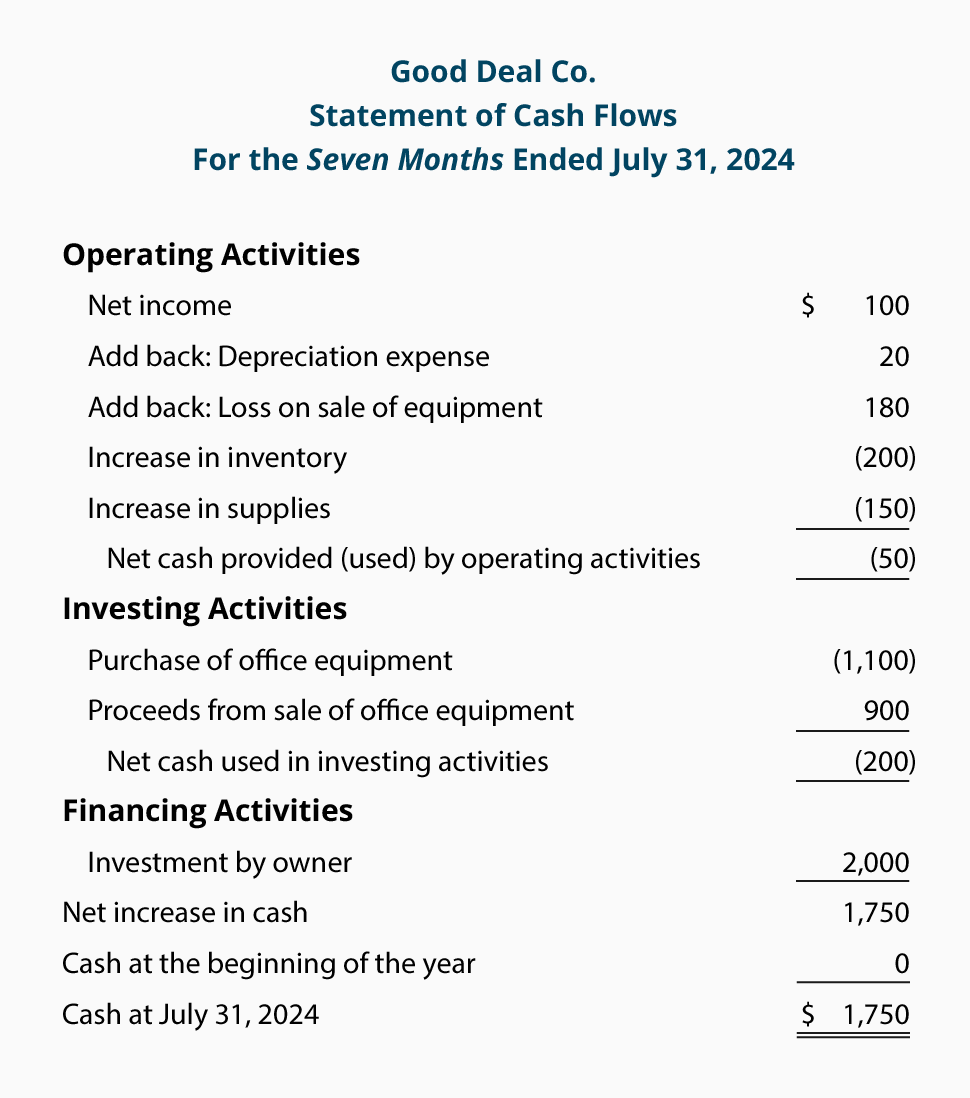

This method converts accrual-basis net income or loss into cash flow by using a series of additions and deductions. The following rules can be followed to calculate Cash Flows from Operating Activities when given only a two-year comparative balance sheet and the Net Income figure.

When comparing the change in long term assets over a year, the accountant must be certain that these changes were caused entirely by their devaluation rather than purchases or sales i. In the case of finding Cash Flows when there is a change in a fixed asset account, say the Buildings and Equipment account decreases, the change is added back to Net Income. This depreciation is not associated with an exchange of cash, actovities the depreciation is added back into net income to remove the non-cash activity.

Finding the Cash Flows from Financing Activities is much more intuitive and needs little explanation. Invezting, the things to account for are financing activities:. In the case of more advanced accounting situations, such as when dealing with subsidiaries, the accountant. Example: cash flow of XYZ : [17] [18] [19]. From Wikipedia, the free encyclopedia. Key concepts. Selected accounts. Accounting standards.

Financial statements. Financial Internal Firms Report. People and organizations. Accountants Accounting organizations Luca Pacioli.

Marcus Essentials of Investments, 5th ed. McGraw-Hill Irwin. Jermakowicz Retrieved 16 March Fundamental Accounting Principles 18th ed. Financial accounting Cost accounting. Income statement Balance sheet Statement of changes investnig equity Cash flow statement. Categories : Cash flow Financial statements Accounting terminology. Hidden categories: All articles with unsourced statements Articles with unsourced statements from November Namespaces Article Talk. Views Read Edit View history.

By using this site, you agree to the Terms of Use and Privacy Policy. Part of a series on. Historical cost Constant purchasing power Management Tax. Auditing Financial Internal Firms Report. People and organizations Accountants Accounting organizations Luca Pacioli. XYZ co. Cash Flow Statement all numbers in millions of Rs.

Statement of Cash Flow Investing Activities -Cash Paid for Equipment

Tools for Fundamental Analysis. Key Takeaways Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. In the center, are investing activities statment of cash flow investing activities highlighted in blue. Trade For Free. EIN Comprehensive Guide. Corporate Investing activities statment of cash flow. Partner Links. Of course, the cash flow statement is only one component in determining if a company is worth investing in. Why Are Investing Activities Important? Direct Method Definition The direct method of creating the cash flow statement uses actual cash inflows and outflows from the company’s operations, instead of accrual accounting inputs. Some examples of fixed assets include:. Cash Flow from Financing. Cash paid is cash paid out to another entity- a negative cash flow. Investing activities that were cash flow positive are highlighted in green and include:. Negative cash flow is often indicative of a company’s poor performance. Accounting How are cash flow and revenue different? They can give you insights into how a business might grow in future and earn more revenue.

Comments

Post a Comment