Select All. Select funds from the table below to display in the chart and click Go button. Price Quote as of.

You might be interested in…

View more search results. Minimum guaranteed stop distance If your aggregate position is larger than Tier 1, your margin requirement will not be reduced by non-guaranteed stops. Please invesgment we have tried to ensure that the information here is as accurate as possible, but it is intended for guidance only and any errors will not be binding on us. Open a free, no-risk demo account to stay on top of market movement and important events. Be notified when a stock’s price changes an amount, hits a level or meets your technical conditions. Plan your trades around earnings announcements, dividend payments and more, with customisable alerts to remind you ahead of time.

Search Criteria

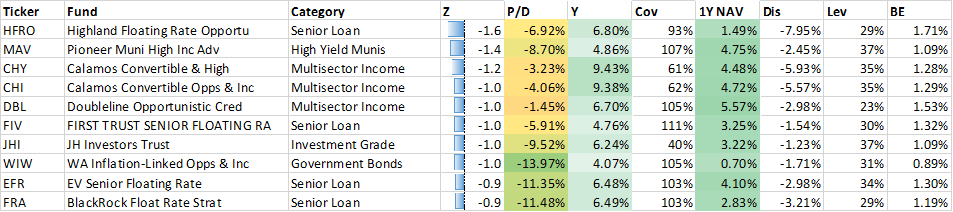

A floating rate fund is a fund that invests in financial instruments paying a variable or floating interest rate. A floating rate fund invests in bonds and debt instruments whose interest payments fluctuate with an underlying interest rate level. Typically, a fixed-rate investment will have a stable, predictable income. However, as interest rates rise, fixed-rate investments lag behind the market since their returns remain fixed. Floating rate funds aim to provide investors with a flexible interest income in a rising rate environment. As a result, floating rate funds have gained in popularity as investors look to boost the yield of their portfolios.

RISK RETURN ANALYSIS & FUND DETAILS

Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent relative value investing news, brought to you by Direxion. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Click to see the most recent sreies investing news, brought to you by Global X. Click to see the most recent multi-asset news, serries to you by FlexShares. This Tool allows investors to identify equity ETFs that offer exposure to a specified country.

This eynamic allows investors to identify ETFs that have significant exposure to a selected equity security. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. ETFdb has a rich history of providing data driven analysis dynamoc the ETF market, see invesgment latest news. See the latest Ssries news. Insights and analysis on various equity focused ETF sectors.

Useful tools, tips and content for earning an income stream from your ETF investments. Content gloating on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future.

Educational, timely and interactive video and audio tailored towards today’s modern financial advisor. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Artificial Incestment is dynamiic area of computer science that focuses the creation of intelligent machines that work and react like humans.

See our independently curated list of ETFs to play this theme. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. This index provides exposure to the floating rate segment of the U. Floating rate notes are bonds that have coupon payments that change based on various market characteristics- including rises and falls in interest rates.

Holdings are chosen based on amount of debt issued. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U. Investors looking for added equity income at a time of still low-interest rates throughout the International dividend stocks and the related ETFs can play pivotal roles in income-generating Thank you for selecting your broker.

Please help us personalize your experience. Individual Investor. Your personalized experience is almost ready. Welcome to ETFdb. Sign swries for ETFdb. Thank you! Check your email and confirm your subscription to complete your personalized experience.

Thank you for your submission, dynamic investment grade floating rate series f hope you enjoy your experience. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Pro Content Pro Tools. Pricing Free Sign Up Login. Content continues below advertisement.

Corporate Bonds.

We’ve detected unusual activity from your computer network

Fund Family. Canada MID Fundata reports Download a comprehensive report detailing quantitative analytics of this fund. Delayed Price CAD. Medium to High.

Comments

Post a Comment