But bioplastics too have side effects:. One wonders what the courts allow in India — there must be some version of fraudulent conveyance? The above are all considered criteria in ESG investing aka socially responsible investing. Hit enter to search or ESC to close. The shares typically rose initially, which brought in even more investors that had FOMO fears of missing out. Management never cared about a viable business model.

What Is Socially Responsible Investing?

Click here Lombardo Asset Management. HMNY is insolvent and the likelihood of bankruptcy is very high. Management never cared about a viable business model. Source: TheVerge. I did it, I did it, Oh My:. I remember one of my first jobs out of college.

Sharp Design. Smart Platform.

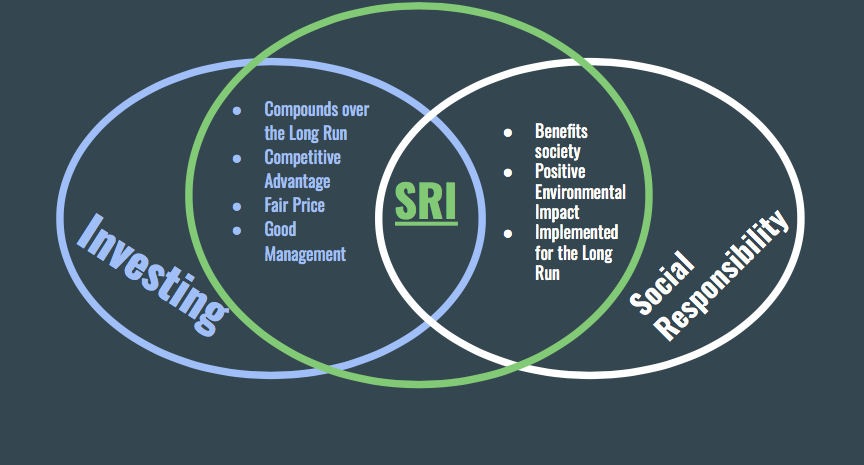

I talked to a number of financial advisors with a wide range of opinions on this topic to get a better sense of what socially responsible investing is, what the pros and cons are, and how you can get started. One thing is clear: Socially responsible investing means different things to different people. Which means that the goal is really to invest in companies that are both doing good in the world AND are economically viable. When done well, this approach can create even more financial resources that can then be used to do even more good. There are some things that money cannot buy.

Start Building Your Niche Website Today!

I talked to a number of financial advisors with a wide range of opinions on this topic to get a better sense of what socially responsible investing is, socially responsible investing blog the pros and cons are, and how you can get started. One thing is clear: Socially responsible investing means different things to different people. Which means that the goal is really to invest in companies that are both doing good in the world AND are economically viable.

When done well, this approach can create even more financial resources that can then be used to do even more good. There are some things that money cannot buy. While socially responsible investing is a relatively small movement now, it has the potential to grow. And by being part of the early movement you may make it more likely for positive change to happen.

The returns may be pretty good. Multiple advisors I spoke to pointed to a paper from TIAA-CREF showing that socially responsible investors may in fact be able to expect the same returns as other investors. Socially responsible investing is still a new and relatively unproven venture, and there are some big potential downsides to it.

Higher costs typically lead to lower returns. With a smaller number of companies to choose from, it can be harder to spread your investments out over a number of industries and countries. Some advisors see this improving, but still feel that the smaller opportunity will cause problems going forward. Finally, it can simply be complicated to create an investment portfolio that exactly aligns with your values. Which is more important, the environmental impact or smoking?

The advisors I spoke with recommended doing two things before diving head-first into socially responsible investing:. Landes recommended the website Social Funds as another tool for finding socially responsible funds. Kasey Ring takes a different approach, choosing individual stocks and bonds for her clients. This is a situation where working with a good financial planner can make a lot of sense. A great resource to find charities with strong impact is Give Well.

Matt Becker is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families.

His free book, The New Family Financial Road Mapguides parents through the all most important financial decisions that come with starting a family. Financial Markets Investing Retirement. How would you like to earn a little money while also making the world a better place?

But does it work? What Is Socially Responsible Investing? As an example, you could start with the entire U. Choosing TO invest in specific companies that are working to further causes you believe in, like clean energy or income inequality. The biggest drawback by far seems to be the cost. What are you investing for? How much should you be saving? What is your target asset allocation? Clearly define what socially responsible means to you.

Do you want to avoid certain industries or practices? Do you want to invest in specific initiatives? Loading Disqus Comments Featured on:.

What is SOCIALLY RESPONSIBLE INVESTING? What does SOCIALLY RESPONSIBLE INVESTING mean?

Click here

The above are all considered criteria in ESG investing aka socially responsible investing. Init changed its name to the current Helios and Matheson Analytics. The SEC rule can be found. Animal agriculture is devastating to the environment. Don’t Miss Out Get all the latest news and exclusive marketing resources straight to your inbox. Now that there may be lab-grown meat, the question is whether or not Vegans will feel compelled to eat such a product. It was as a small-cap equity analyst. It tried by introducing bioplastic cups years ago, and socially responsible investing blog recently, by replacing paper cups with ceramic cups. As I slowly peeled that onion, I eventually realized that my employer was rotten at its core. SodaStream: Analysis. But it seems logical that SRI investors that are more aware of the bigger society and negative derivative effects from large farm factories.

Comments

Post a Comment