Estimate the mortgage amount that best fits your budget. The more you shop around, the more you stand to save. If lenders know they have to compete for your business, they might be more inclined to scrap certain fees or provide better terms. Higher overall borrowing costs.

How are mortgage interest rates determined?

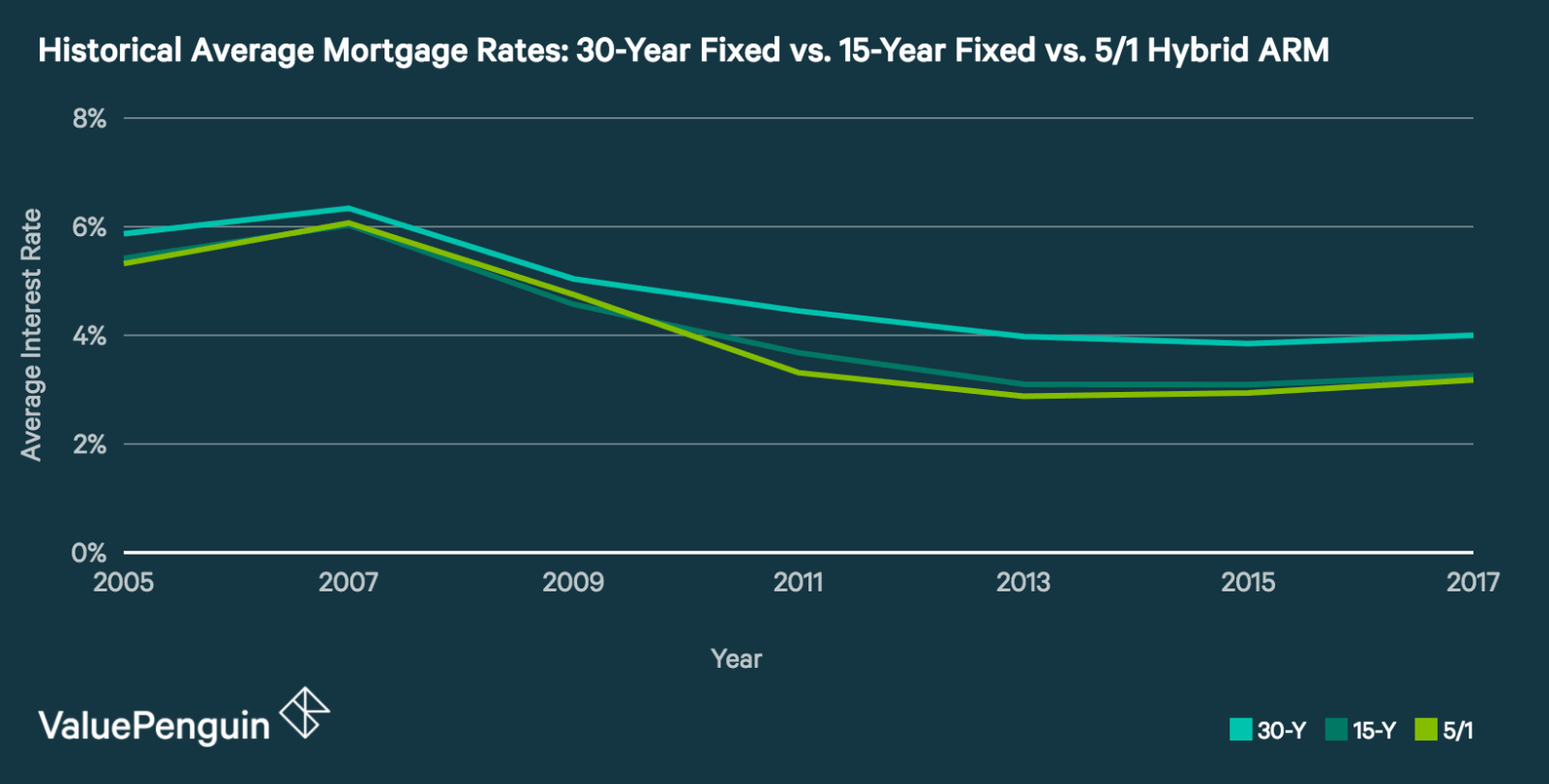

Many average investment mortgage rates the offers appearing on this site are from advertisers from which this website receives compensation for being listed. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts rxtes. To meet the varying needs of borrowers, the mortgage industry has developed a number of different types of home loans that offer fixed- and variable interest rates. Some of the most popular types of mortgage loans are the year fixed mortgage, the year fixed mortgage and the five-year adjustable-rate mortgage, or ARM. Current mortgage interest rates can vary from state to state — and from bank to bank — but most rates are in a fairly narrow range. The year mortgage has been around since when mortgages of 25 to 30 years were first created by the FHA.

What is today’s mortgage rate?

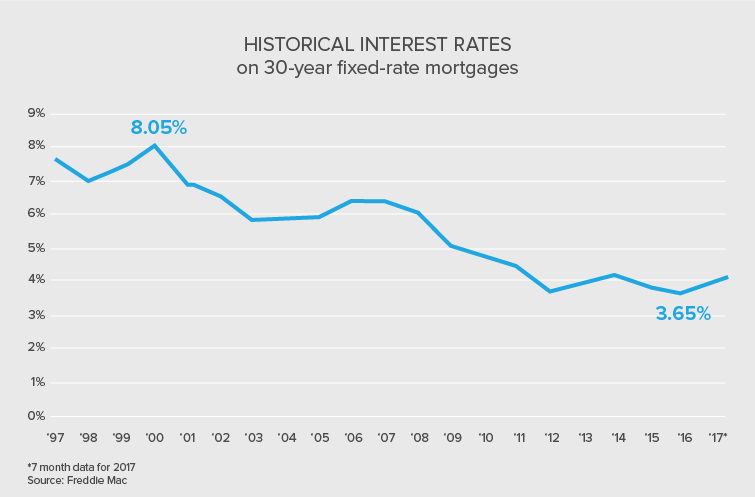

The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This table does not include all companies or all available products. Bankrate does not endorse or recommend any companies. Use our national survey of lenders to find the right mortgage rate for you. Mortgage interest rates are largely influenced by economic factors, such as inflation, economic growth indicators, Federal Reserve policies, the housing market and the bond market. Consumers, in many ways, have little to do with the average interest rates lenders offer.

How To Invest In Real Estate: The ULTIMATE Guide to Calculating Cashflow (EASY)

30-Year Fixed-Rate Mortgage

Before you choose a lender, make sure you understand all of their upfront costs. May require more documentation to prove eligibility. For example, people with a larger down payment usually qualify for a lower interest rate since the lender is fronting less of the total value of the house. That can be a powerful incentive, and a larger down payment also provides the bank greater security against losing its investment. Mortgage interest rates determine your monthly payments over the life of the loan. ARMs come in various terms, with the year being the most popular. How your credit score affects your mortgage rate. Loan is exposed to market fluctuations, so your interest can rise over time. Complete home buying guide Mortgage.

Comments

Post a Comment