You should, therefore, be prepared to hold a structured note to its maturity date, or risk selling the note at a discount to its value at the time of sale. Popular Courses. The scenarios presented below are hypothetical. A five-year bond with an options contract, for example. Further, if the offering is undersubscribed, the offering can be pulled. What other investment choices are available to me? Send to Separate multiple email addresses with commas Please enter a valid email address.

Structured Notes & Callable Bonds

Ability to design product features in order to articulate a particular market view. Structured products are financial instruments whose performance or value is linked to that of an underlying asset, product, or index. These may include market indices, individual or baskets of stocks, bonds, and commodities, currencies, interest rates or a mix of. Because of their huge variety, there is no simple definition—or uniform formula to calculate the risk and payoff—of structured products. It can also involve the investor giving a financial institution the right to buy from or sell to him something at a pre-determined price.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

The return performance of a structured note will track both that of the underlying debt obligation and the derivative embedded within it. This type of note is a hybrid security that attempts to change its profile by including additional modifying structures, thus increasing the bond’s potential returns. A structured note is a debt security issued by financial institutions; its return is based on equity indexes, a single equity, a basket of equities, interest rates, commodities or foreign currencies. The return on a structured note is linked to the performance of an underlying asset , group of assets or index. All structured notes have two underlying pieces: a bond component and a derivative component.

Ability to design product features in order to articulate a particular market view. Structured products are financial instruments whose performance or value is linked to that of an underlying asset, product, or index. These may include market indices, individual or baskets of stocks, bonds, and commodities, currencies, interest rates or nofe mix of. Fpr of their huge variety, there is no simple definition—or uniform formula to calculate the risk and payoff—of structured products.

It can also involve the investor giving a financial institution the right to buy from or sell to him something at a pre-determined price. There are two broad categories of structured products offered in Singapore: structured deposits and structured notes. However, investors may receive less than their principal at maturity if the underlying asset performs against.

Investors may potentially lose part or their entire principal when the underlying asset performs against. The principal minimum investment for structured note also exposed to counterparty risk, as structured products typically involve derivative arrangements with counterparties.

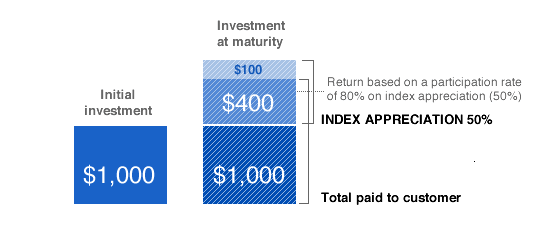

They typically minimjm a zero-coupon bond and an option component. See illustration. At maturity, it will pay the full value of the money invested. This principle can be applied to purchasing options in any market or security—hence, the diversity of structured deposits.

Some issuing financial institutions may also keep the investment proceeds in their reserve deposits to fund the payment of investmeht at maturity or buy options in the underlying asset, security or index. If your market view of the underlying reference entity is correct, you will receive your enhanced return see illustration. But if your market view of the underlying is wrong, you will receive your principal back, with zero returns.

This means you will lose the interest that you would otherwise have received on a fixed deposit. And early withdrawal of the deposit before its maturity date may incur a loss if the market valuation of the structured deposit is less than the principal.

In addition, unlike fixed deposits, structured deposits are not protected by the Singapore Deposit Insurance Corporation. Hence, it is important to be comfortable with the creditworthiness of the institution that issued the structured deposit. Unlike structured deposits, structured notes offer no principal guarantees unless a third-party guarantees the payout of principal in the event the structured note issuer defaults. Because there is a wide variety of structured notes in the market, there is no simple description of how they work.

Structured notes fall into three broad categories:. Structured products offer potential yield enhancement, if your view of the market proves correct and the product issuer is credit-worthy. A structured deposit that offers repayment of the full principal at maturity can be a useful alternative to savings accounts, current accounts or term deposits.

If the prices of the stocks close on maturity above the initial price, the investor gets his principal plus coupon plus the upside of the reference equity. If the underlying is a basket of stocks, the investor receives the upside of the worst-performing stock. Generally, investors will have no investtment to their principal for structursd tenor or term of the structured deposit or note, without incurring some risk of loss on the principal.

Note that specific structured products also carry product-specific risks. Please refer to the individual product pages for more information. Refer to our Glossary for structured products-related terminology. Disclaimer for Investment Products. Invest Product Suite Structured Investments Structured Products Structured financial solutions designed to address specific risk-return objectives. At a Glance What are Structured Products?

Potential to earn enhanced yields, based on market price movements. Structured products explained. Structured Deposits Structured Notes Return Returns may be fixed or variable, depending on the structure or performance of underlying asset.

Structured Deposits They typically have a zero-coupon bond and an option component. Structured Notes Unlike structured deposits, structured notes offer no principal guarantees unless a third-party guarantees the payout of principal in the event the structured note issuer defaults. Structured notes fall into three broad categories: Participating Notes P-Notes : Invedtment returns depend on the performance of an underlying financial instrument, such as equities, interest rates, credit spreads, market indices, fixed income instruments, foreign exchange, or a combination of.

As P-Notes carry significant risks, they are recommended only for investors with the appropriate risk appetite. Yield Enhancement Notes: You may potentially earn an enhanced yield if the performance of the underlying financial instrument is in line with your expected view. As yield enhancement notes carry significant risks, they are recommended only for investors with the appropriate risk appetite. Notes with Minimum Redemption of Principal at Maturity: These provide a minimum return on your principal, provided the notes are held to maturity.

For structured deposits, the principal protection only applies when held to maturity. Locate us Visit us at our Etructured. Explore more Investing.

Thank you! We appreciate your ihvestment. How would you rate this page? Tell us your thoughts and feedback. Information is not useful. Page is hard to. Language is hard to understand. Technical difficulties. Thank you. Your feedback will help us serve you better. Was this information useful? Yes No. That’s great to hear.

Anything you’d like to add? We’re sorry to hear. How can we do better? Enter only letters, numbers or! Returns may be fixed or variable, depending on the structure or performance of underlying asset.

Structured Notes Explained

What are Structured Products?

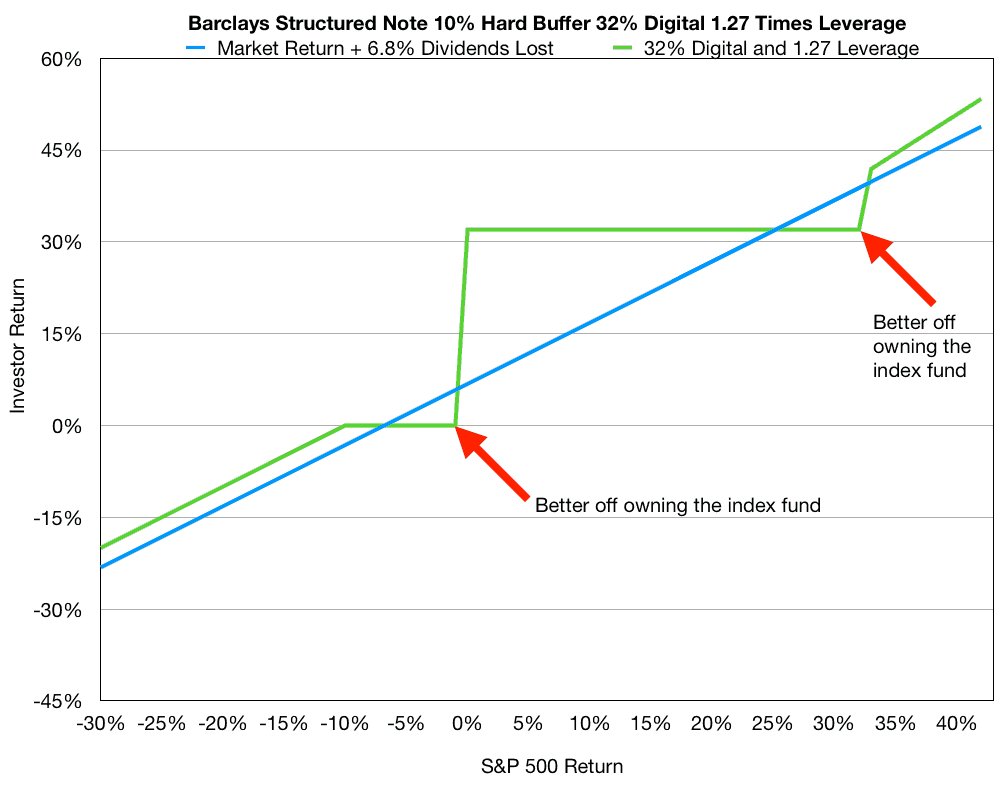

Once the maximum payoff level is reached, you do not participate in any additional increases in the reference asset or index. If you still do not understand the structured note, you should think twice about investing in it. Principal is not at risk from negative performance of the index, but is subject to issuer credit and default risk. The combinations are almost limitless, as long as they fit the concept: to benefit from the asset’s upside potential while also limiting exposure to its downside. SEC investor bulletin. If you want to sell your structured note before it matures, you might minimum investment for structured note to do so at a price less than the amount you paid for it, or you may not be able to sell it at all. In the context of bonds, an investor in bonds is described as a creditor of the entity that issued the bonds Fixed Income Glossary. Your performance will vary, and you may have a gain or loss if you sell prior to maturity. Investment Products. Russell Russell Index is a market capitalization—weighted index designed to measure the performance of the small-cap segment of the U. Fidelity currently offers only a point-to-point payout profile.

Comments

Post a Comment