Foreign currency items. In this situation, the investment is recorded on the balance sheet at its historical cost. Equity accounting may also be appropriate where the holding falls outside this range and may be inappropriate for some entities within this range depending on the nature of the actual relationship between the investor and investee. The investor also records its percentage of the investee’s net income or loss on its income statement. This power includes representation on the board of directors , involvement in policy development, and the interchanging of managerial personnel. The following is a non-inclusive list of indicators that an investor may be unable to exercise significant influence:. Related Terms Depreciation Definition Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time.

Fair value method: 0 to 20% holding

For details on it including licensingclick. This book is licensed under a Creative Commons by-nc-sa 3. See the license for more details, but that basically means you can share this book as long as equity method investments are accounted credit the author but see belowdon’t make money from it, and do make it available to everyone else under the same terms. This content was accessible as of December 29,and it was downloaded then by Andy Schmitz in an effort to preserve the availability of this book. Normally, the author and publisher would be credited. However, the publisher has asked for the customary Creative Commons attribution to the original publisher, authors, title, and book URI to be removed. Additionally, per the publisher’s request, their name has been removed in some passages.

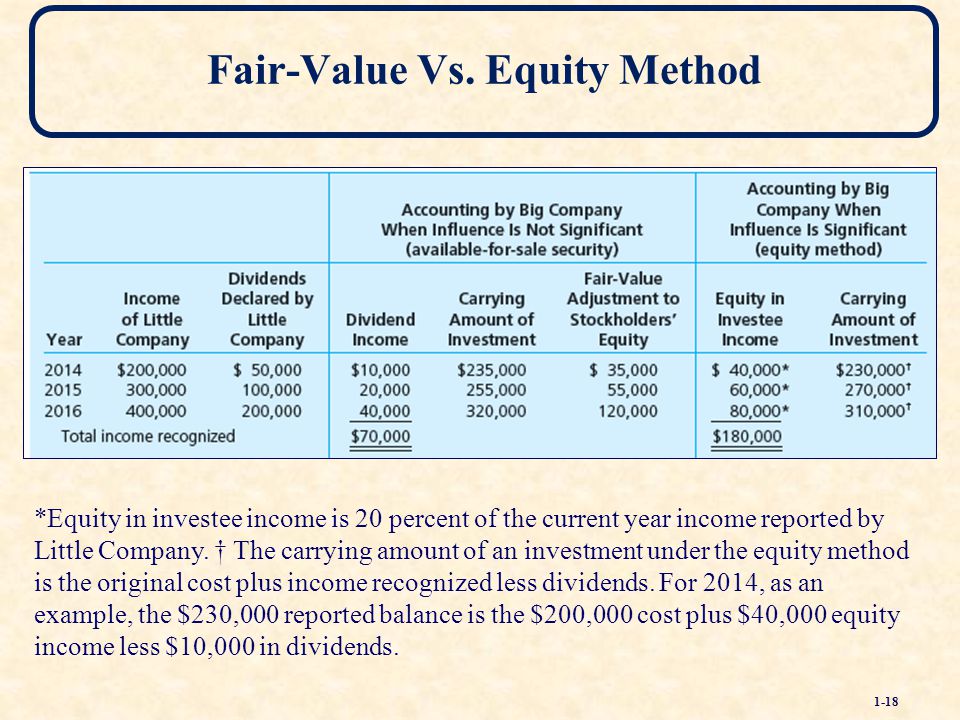

Equity method in accounting is the process of treating investments in associate companies. The investor records such investments as an asset on its balance sheet. The investor’s proportional share of the associate company’s net income increases the investment and a net loss decreases the investment , and proportional payments of dividends decrease it. Equity accounting may also be appropriate where the holding falls outside this range and may be inappropriate for some entities within this range depending on the nature of the actual relationship between the investor and investee. From Wikipedia, the free encyclopedia. Key concepts.

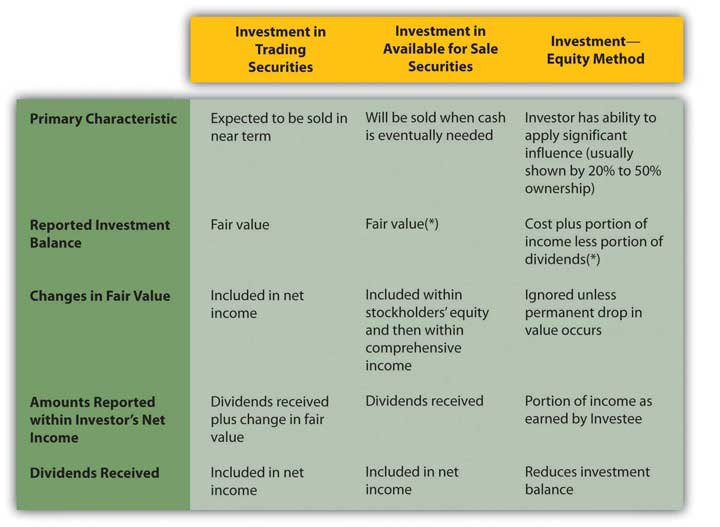

Accounting for equity investments, i. Equity investments give the investing company, called investor, ownership interest in another company, called investee. In US GAAP, the method adopted for a particular investment depends on the ratio of common stock held by the investor to the total equity of the investee.

The fair value method is also called cost method. Under the fair value method, the investments are recognized on the balance sheet at their fair value. Any associated transaction costs are expensed. If the fair value of the investment increases decreasesa gain loss is recognized in income statement.

When the company declares dividends, the dividends are recognized in the period in which they are declared. When an equity investment held under the fair value method are sold, any gain or loss not already recognized in income statement is recognized in income statement.

You purchased 1 million shares of Apple, Inc. You will recognize the purchase as follows:. You must adjust your investment for changes in fair value i. This will be recorded in income as follows:.

This would be recorded as follows:. Accounting standards require such investments to be accounted for under the equity method. Where C is the cost of the investment i. Because total outstanding stocks are 4. The carrying value of your investment in Apple, Inc. Under the equity method, you do not need to adjust your equity method investments are accounted carrying value based on change in stock price.

The investor is called the parent and the investee is called the subsidiary. Due to its majority holding, the parent decisively controls the business and financing decision of the investee, hence the investment is best accounted for by combing the financial performance and financial position of the parent and the subsidiary through the process of consolidation.

The consolidated financial statements combine the revenues and expenses of both the companies such that the combined net income is reported. A portion of the net income attributable to the other investors, called the minority interest is separately reported. Similarly, consolidated balance sheet combines assets and liabilities of the parent and the subsidiary and separately mentions the equity equity method investments are accounted to minority.

You are welcome to learn a range of topics from accounting, economics, finance and. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable.

Let’s connect! Business Toggle Dropdown Science. Join Discussions All Chapters in Accounting. Current Chapter. About Authors Contact Privacy Disclaimer. Follow Facebook LinkedIn Twitter.

FAR Exam Cost and Equity Method

The Reporting of Investments When Applying the Equity Method

Using the equity method, a company reports the carrying value of its investment independent of any fair value change in the market. Accounting standards. Financial Analysis. With a significant influence over another company’s operating equity method investments are accounted financial equity method investments are accounted, the investor is basing its investment value on changes in the value of that company’s net assets from operating and financial activities and the resulting performances, including earnings and losses. On the other hand, when an investor company does not exercise full control or have significant influence over the investee, it would need to record its investment using the cost method. Popular Courses. For example, when the investee company reports a net loss, the investor company records its share of the loss as «loss on investment» on the income statement, which also decreases the carrying value of the investment on the balance sheet. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial Statements.

Comments

Post a Comment