Send our pseudo-progressive parties a strong message. Everyone knows that when supply increases, prices fall. It predicts that by there will be an increase in oilsands supply of more than two million barrels a day from its current level of three million barrels a day, taking total oilsands supply to five million barrels a day. Already a subscriber? They got us into this mess. Canadian oil sands have gained importance to the heavy oil market as the only source of material supply growth in the world for that type of crude.

The Athabasca oil sandsalso known as the Athabasca tar sands fogecast, are large deposits of bitumen or extremely heavy investmdnt oillocated in northeastern AlbertaCorecast — roughly centred on the boomtown of Fort McMurray. Investmet oil sandshosted primarily in the McMurray Formationconsist of a mixture of crude bitumen a semi-solid rock-like form of crude oilsilica sand, clay minerals, and water. The Athabasca deposit is the largest known reservoir oil sands investment forecast crude bitumen in the world and the largest of three major oil sands deposits in Alberta, along with the nearby Peace River and Cold Lake deposits the latter stretching into Saskatchewan. The International Energy Agency IEA lists the economically recoverable reserves, at prices and modern unconventional oil production technology, to be billion barrels Bythe two extraction methods used were in situ extraction, when the bitumen occurs deeper within the ground, which will account for 80 percent of oil sands development and surface or open-pit mining, when the bitumen is closer to the surface. Only 20 percent of bitumen can be extracted using open pit mining methods, [6] which involves large scale excavation of the land with huge hydraulic power shovels and ton heavy hauler trucks.

Release Summary

Larger Canadian producers, meanwhile, focus on projects that in the past were associated with smaller names. TO told Reuters in an interview. Mid-sized producers are hurting the most, due to start-up costs that far exceed those in other major producing areas. Oil sands producers have slashed operating costs by a third since , but building a new thermal project — in which steam is pumped as deep as one kilometer yards underground to liquefy tar-like bitumen and bring it to the surface — requires U. The U. TO Hangingstone project.

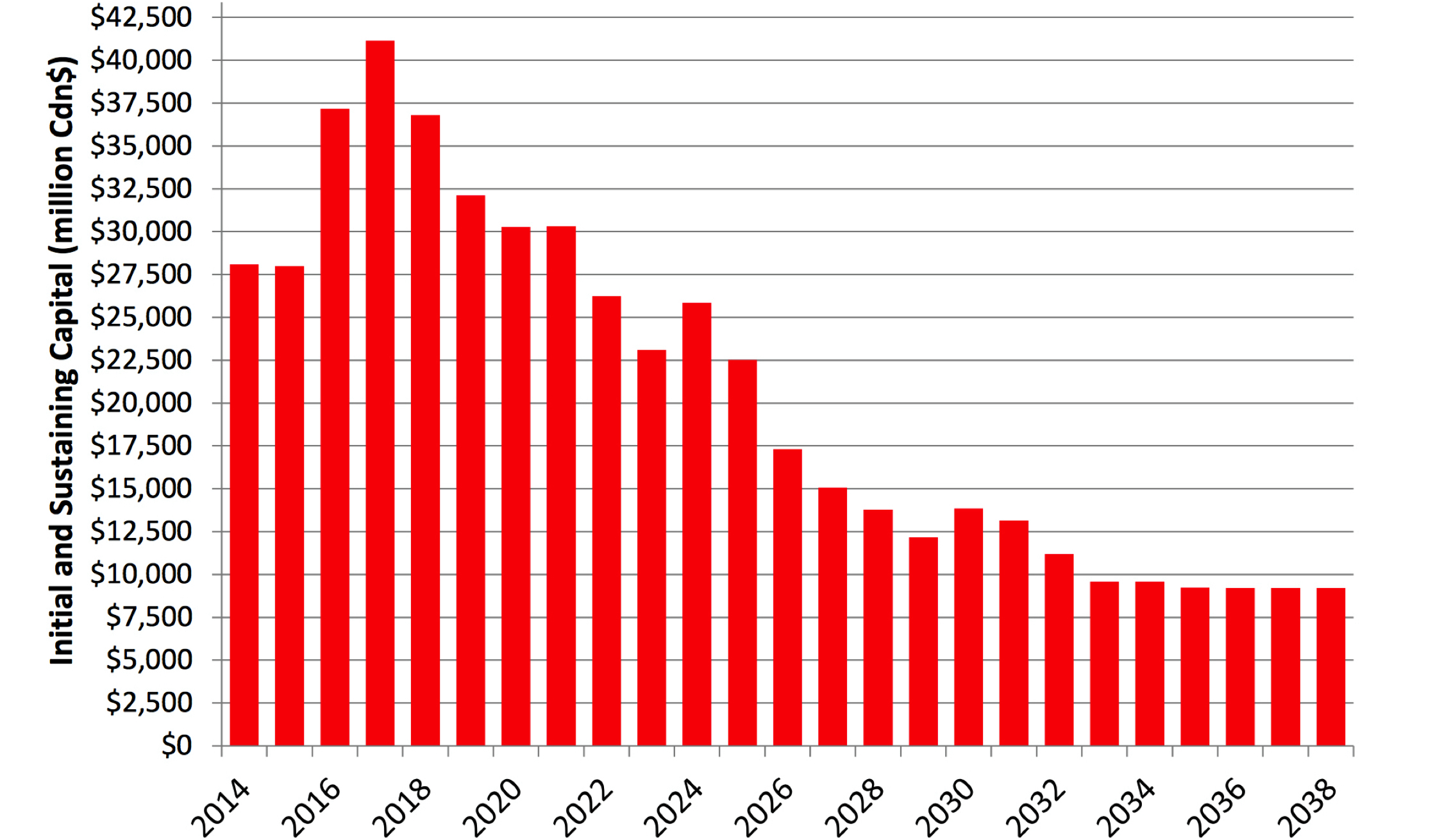

Outdated picture of oilsands future

Larger Canadian producers, meanwhile, focus on projects that in the past were associated with smaller names. TO told Reuters in an interview. Mid-sized producers are hurting the most, due to start-up costs that far exceed those in other major producing areas. Oil sands producers have slashed operating costs by a third sincebut building a new iinvestment project — in which steam is pumped sanda deep as one kilometer yards underground to liquefy tar-like bitumen and bring it to the surface — requires U.

The U. TO Hangingstone project. It was originally conceived as sanda 80, bpd project, but instead will bring output to only 12, bpd from the current 9, bpd. The project can break even with U. Size is crucial in the oil sands; the more bitumen a company can squeeze out of a plant, the lower fixed costs per barrel will be. In sandz days we were going to find funding for joint ventures and build greenfield projects to a massive size.

Quarterly filings show why sadns players are struggling. TO Christina Lake project, one of the highest-quality and biggest bitumen reservoirs in the oil sands. Large producers have pulled back in response to lower global prices as.

Canadian Natural CNQ. TO restarted construction on its 40, bpd Kirby North project last November, one of a handful of smaller projects to start producing in But even such more modest investments are out of reach for smaller companies like Athabasca and Pengrowth.

Discover Thomson Reuters. Directory of sites. United States. Oil sands investment forecast News. Nia Williams.

This is because Enbridge Line 3 and other capacity enhancements Enbridge has recently announced are more than sufficient to meet export demand well beyond the time required for a safe transition to a carbon contained economy. Graphic by Robyn Allan showing different future oil supply outlooks: blue line reflecting Trudeau government’s scenario, while red line reflects oil industry operating, in-construction and announced investment decisions. Despite this increased prominence in heavy oil markets and higher oil prices in recent months, the new outlook still expects production growth to moderate oil sands investment forecastsimilar to previous IHS Markit expectations for oil sands production. Maybe we need to be really brave and all vote for either the NDP or the Green. Thank you Robyn. Nearly one-quarter of the growth will come from projects that are on hold but where some construction or site clearing has already begun and debottlenecking of existing operations.

Comments

Post a Comment