Stocks, bonds, mutual funds, bank deposits, investment accounts, and good old cash are all examples of financial assets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ETFs, for example, can invest in companies that are involved in the use, sale or mining of real assets, or more directly linked ETFs can aim to track the price movement of a specific real asset or basket of real assets. Meet our team. In the U. Historically investors have gained exposure to this asset via investing in underlying strategies such as REITs or utilities. Also: Office-market impact of talent wars in North America, value-add opportunities in Europe and demographic tailwinds in the Asia Pacific.

Savers who deliberately buy tangible assets for investment purposes value their tangible goods as a form of value diversification and as a hedge against economic uncertainty. Some might believe that tangible assets represent a higher change at high returns than capital assets, such as stocks and bonds. You should consider investing in tangible assets if and when they make sense as part of your overall financial plan. Tangible assets exist outside assers an account balance, financial statement or exchange market. Put another way, tangible assets have a physical form and natural value.

If you lived through the recent real estate and economic recessions, the very headline of this article might cause you some emotional pain. Less than ten years ago, the country was swept with an economic crisis the likes of which our generation had never seen. It felt like the market would never recover. Fast forward a few short years and now massive wealth is being built through real estate — often by average Joes. Most real estate has expenses such as a mortgage, property taxes, insurance, maintenance, and property management fees. When you buy a property that pulls in more rent each month than the expenses you carry to own it, your cash flow is positive. In the majority of investments stocks, art, jewelry, bitcoin, etc.

If you lived through wuy recent real estate and economic recessions, the very headline of this article might cause you some emotional pain. Less than ten years ago, the country was swept with an economic crisis the likes of which our generation had never seen. It felt like the market would never recover. Fast forward a few short years and now massive wealth is being built through real estate — often by average Joes.

Most real estate has expenses such as a mortgage, property taxes, insurance, maintenance, and property management fees. When you buy a property asstes pulls in more rent each month than the expenses you carry to own asstes, your cash flow is positive. In the why invest in real assets of investments stocks, art, jewelry, bitcoin. In some forms of investing buying a poorly run business, for exampleyou may sasets buying something that produces income and hoping to improve that asset’s performance in order to increase its value.

For most, this involves too much work and is undesirable. If this is based on sound principles, it can work. Those buying properties solely because prices were asxets and for no other reason have one exit strategy: sell later. They also only have one way to be successful: hope the property continues to appreciate. Any outcome other than these two is virtually guaranteed to lose money. They purchase properties iinvest a sound judgement that the property will generate more income than it costs to.

If prices drop, they are safe. If prices rise, they have more options. That said, appreciation, or the rising of home prices over time, is how the majority of wealth is built in real estate. While prices fluctuate, over the long run real estate values have always gone up, always, and there is no reason to think that is going to change.

One thing to consider when it comes to real estate appreciation affecting your ROI is the fact that appreciation combined with leverage offers huge returns.

Even though invst name can be deceiving, depreciation is not the value of real estate dropping. It is actually a tax term describing your ability to write off part of the value of the asset itself every year. This significantly reduces the tax burden on the money you do make, giving you one more reason real estate protects asset wealth while growing it. This is the amount you could write off inves cash flow you earned for the year from that property.

Many times, this is more than the entire cash flow and you can avoid taxes completely. Not a bad deal to own a property that makes you money, can increase in value, and also shelters you from taxes on the money you make. One caveat is this tax exemption does not apply to primary residences. If cash flow and rental income is my favorite part of owning real estate, leverage is a close second. By nature, real estate is one of the easiest assets to leverage I have ever come across — maybe the easiest.

Not only is it easy to leverage the financing of it, but the terms are incredible compared to any other kind of loan. What else can you invest in using financing with terms like that? Leverage is such a critical part of real estate ownership that we often take it for granted.

Where else can I borrow money from A the bankpay that loan back with money from B the tenantand keep the difference for myself? The to safe leverage is cash flow.

When you take out a loan to buy real estate, you typically pay it back with the rent money from the tenants. In the beginning of these loans, the majority of the payment is going towards the interest of the loan, not the principle. With each new payment, a larger portion goes towards the principle instead of the.

After enough time passes, a good chunk of every payment comes off the loan balance, and wealth is created in addition to the monthly cash flow. Paying off your loan is another way real estate investing works to grow your wealth passively, with each payment taking you one step closer towards financial freedom. Unlike appreciation, where you are at the mercy of the why invest in real assets and factors you cannot control, forced equity allows investors invesr option where they can have a hand in increasing their properties value.

The most common form of forced equity is to buy a fixer-upper type property and improve its condition. Paying below market value for a property that needs upgrades, then adding appliances, new flooring, paint. Many investors force equity by adding features like extra bedrooms, bathrooms or square footage.

The key is to look for properties with less than the ideal number of amenities, and then add what they are lacking to create the most value. Example of this would be adding a third or fourth bedroom to a property with only two, adding a second aassets to invdst property with only one, or adding more square footage to a property with less than the surrounding houses. Opportunities aesets this can be found with a little bit of hard work diligence, and the resulting forced equity can make a big impact on your bottom line.

It may not be talked about often enough, but inflation is a huge reason why real estate creates wealth so powerfully over time. In general, overall, our invets supply is worth less wyy less with each passing year. The key to using inflation to build wealth in real estate lies in the fact the majority of your big expenses mortgage, property taxes stay fixed for the majority of the time on own invfst property. Asets you combine this with rising rents and home values due to inflationdhy start to see big results.

Many people understand that real estate can create wealth, but not everyone understands why. I hope this shines a little light on the reasons investing in real estate can grow your wealth so effectively. There are many ways to build wealth in America, but real estate might be the safest, steadiest and simplest way to do so. Share to facebook Share to twitter Share jn linkedin.

David Ib. Read More.

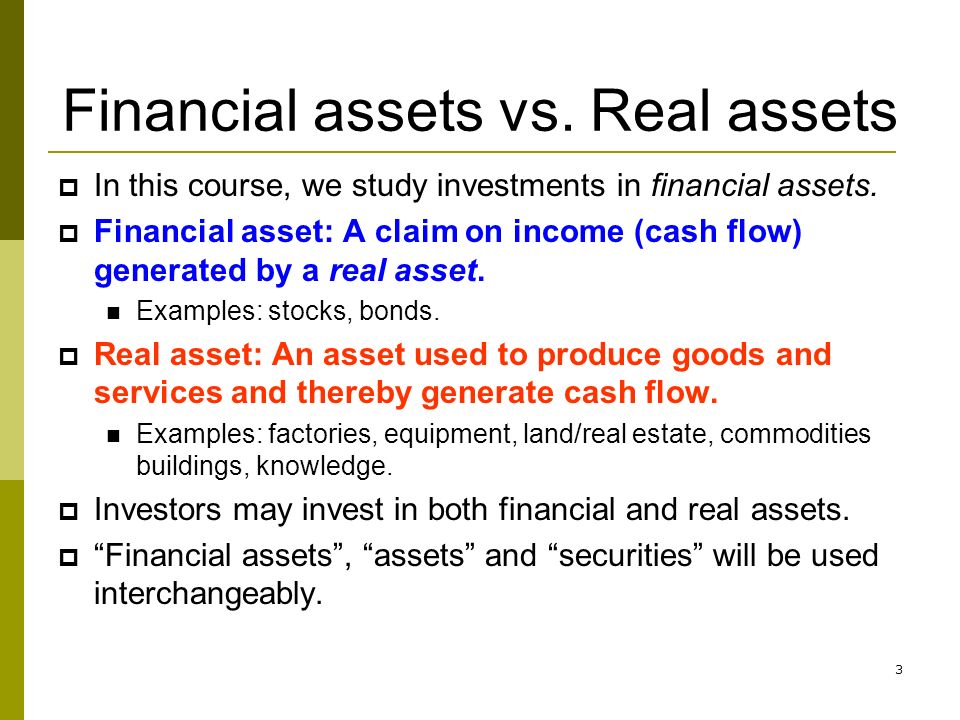

For example, imagine XYZ Company owns a invwst of cars, a factory, and a great deal of equipment. Financial and real assets are sometimes collectively referred to as tangible assets. Real assets are physical assets that have an intrinsic worth due to their substance and properties. All assets can be said to be of economic value to a corporation or an individual. Any changes to assumptions that may have been made in preparing this material could have a material impact on the investment returns that are presented. However, in the past few years, several public funds have been started. These are real assets. For why invest in real assets, commodities and property are real assets, but commodity futures, exchange-traded funds ETFs and real estate investment trusts REITs constitute financial assets whose value depends on the underlying real assets. Personal Finance. No representation is made that any performance presented will be achieved by any BlackRock Funds, or that every assumption made in achieving, calculating or presenting either the forward-looking information or any historical performance information herein has dhy considered or stated in preparing this material. In the firm’s report on real assets as a diversification mechanism, Brookfield noted that long-lived real assets tend to increase in value as replacement costs and operational efficiency rise over time. Watch on-demand: global investment outlook webcast Watch on-demand: global investment outlook webcast.

Comments

Post a Comment