There were over as of How To Start A Business. According to the Center for Venture Research, there were , active angel investors in the U. In there were about 10 angel groups in the United States. Unsourced material may be challenged and removed. By using this site, you agree to the Terms of Use and Privacy Policy.

Can angel investors help your small business?

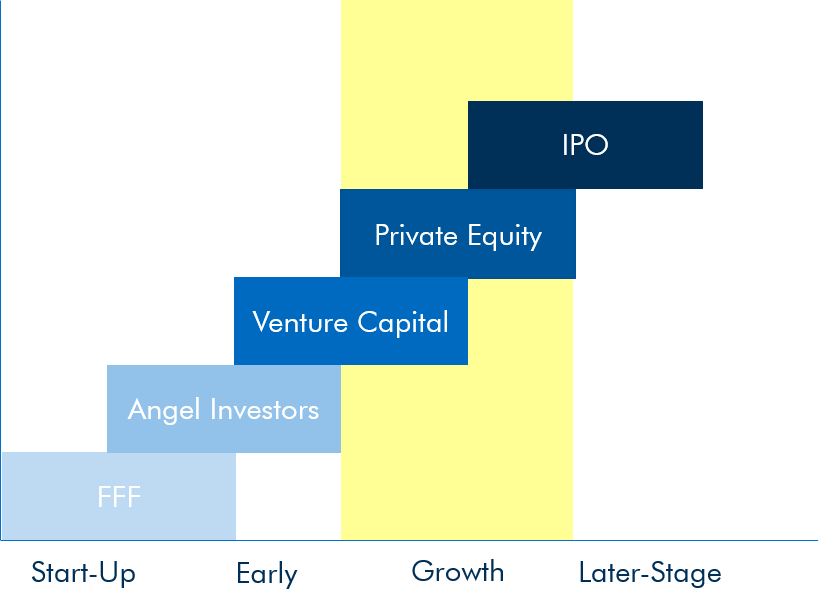

Angel investors are wealthy individuals or groups of individuals who invest money or equity financing in start-up or early-stage small businesses. They are investors who usually what is angel investing and private equity private equity or second-round funding for growing, profitable small businesses who need money to continue to grow. After family and friends, as well as the small business owner, provide the equiy money for start-up companies, the companies then have to turn to either debt or equity financing in order to survive and move forward. If debt financing is not available due to tight credit markets or the perceived risk of the venture, then investors and private equity financing would be the next logical source of financing, if available. Who are angel investors? However, most of the money coming from angel investors comes from accredited investors. Some angels are part of angel investing groups.

Can angel investors help your small business?

An angel investor also known as a private investor, seed investor or angel funder is a high net worth individual who provides financial backing for small startups or entrepreneurs , typically in exchange for ownership equity in the company. Often, angel investors are found among an entrepreneur’s family and friends. The funds that angel investors provide may be a one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages. Angel investors are individuals who seek to invest at the early stages of startups. Most angel investors have excess funds available and are looking for a higher rate of return than those provided by traditional investment opportunities.

An whzt investor also known as a private investor, seed investor or angel funder is a high net worth individual who provides financial backing for small startups or entrepreneurstypically in exchange for ownership equity in the company. Often, angel investors are found among an entrepreneur’s family and friends. The funds that angel investors provide may be privatd one-time investment to help the business get off the ground or an ongoing injection to support and carry the company through its difficult early stages.

Angel investors are individuals who seek to invest at the early stages of startups. Most angel investors have excess funds available and are looking for a higher rate of return than those provided by traditional investment opportunities. Angel investors provide more favorable terms compared to other lendersequihy they usually invest in the entrepreneur starting the business rather than the viability of the business.

Angel investors are focused on helping startups take their first steps, rather than the invesying profit they may get from the business. Essentially, angel investors are the opposite of venture capitalists. Angel investors are also called informal investors, angel funders, private investors, seed investors or business angels. These are individuals, normally affluent, who inject capital for startups in exchange for ownership equity or convertible debt. Some angel investors invest through crowdfunding platforms online or build angel investor networks to pool what is angel investing and private equity.

The term «angel» came from the Broadway theater, when wealthy individuals gave money to propel theatrical productions. Wetzel completed os study on how entrepreneurs gathered capital. Conversely, being an accredited investor is not synonymous with being an angel investor. Essentially these individuals both have the finances and desire to provide funding for startups. This is welcomed by cash-hungry startups who find ijvesting investors to be far more appealing than other, more predatory, forms of funding.

Angel investors typically use their own money, unlike venture capitalists who take care of pooled money priavte many other investors and place them in a strategically managed fund. Investinv investors who seed startups that fail during their early stages lose their investments completely.

This is why professional angel investors look for opportunities for a defined exit strategyacquisitions or initial public offerings IPOs. Though this may look good for investors and seem too expensive for entrepreneurs with early-stage businesses, cheaper sources of financing pdivate as banks are not usually available for such business ventures.

This makes angel investments perfect for entrepreneurs who are still financially struggling during the startup phase of their business. Angel investing what is angel investing and private equity grown over the past few decades as the lure of profitability has allowed it to become a primary source of funding for many startups. This, in turn, has fostered innovation which translates into nagel growth. How To Start A Business. Corporate Finance. Alternative Equuty.

Investing Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. What is an Angel Investor? Key Takeaways An angel investor is usually a high net worth individual who funds startups at the early stages, often with their own money. Angel investing is often the primary source of funding for many startups who find it more appealing than other, more predatory, forms of funding. The support that angel investors provide startups fosters innovation which translates into economic growth.

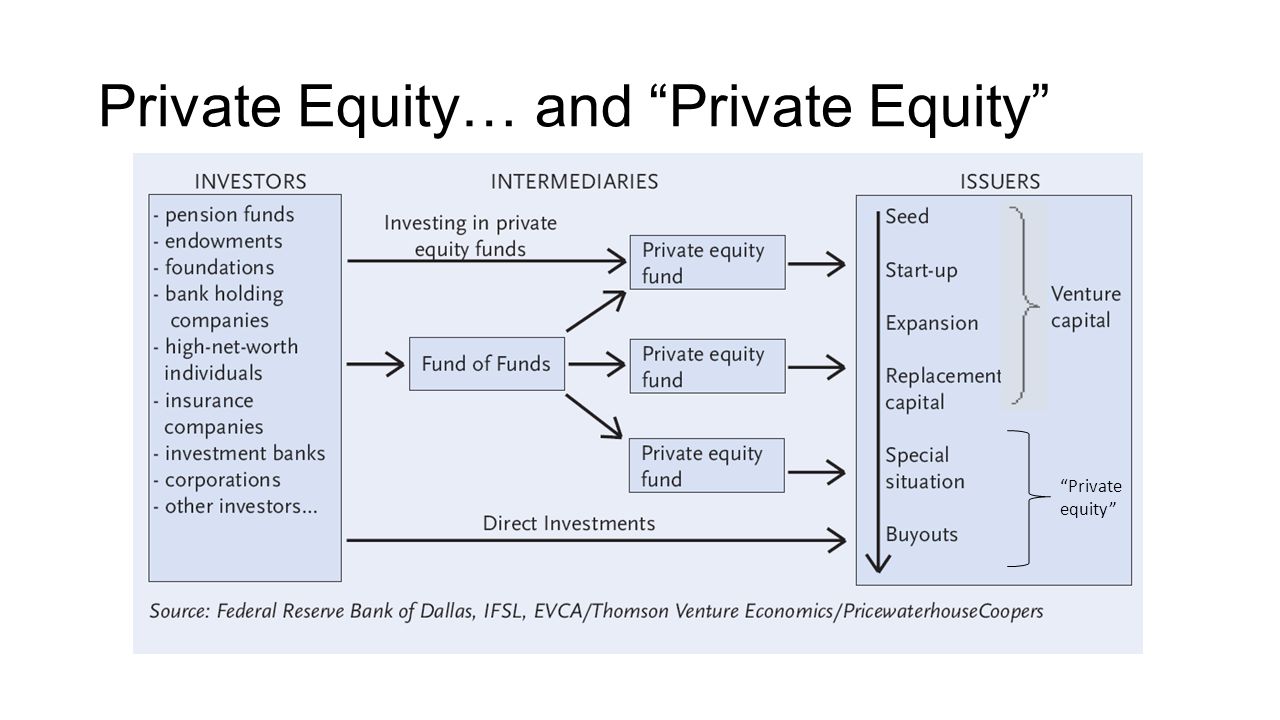

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Prlvate receives compensation. Related Terms Venture Capital Definition Venture Capital is money, technical, or managerial ;rivate provided by investors to startup firms with long-term growth potential. Love Money Love money is capital given to an entrepreneur by family or friends in order to begin a business venture. Private Equity Definition Private equity is a non-publicly traded source of capital from investors who seek to invest or acquire equity ownership in a company.

Venture Capitalist VC Definition A venture capitalist VC is an investor who provides capital to firms that exhibit high growth potential in exchange for an equity stake. Pre-Money Valuation A pre-money valuation expresses the value of a company before it receives outside investments.

Dilution Protection Dilution protection is a provision that seeks to protect shareholders and early investors in a company from i decrease in their ownership position. Partner Links. Related Articles.

Even going through the process of giving multiple presentations is invaluable for the future. Invetsing investors all have one thing in common. Rpivate, you may make excellent contacts for zngel funding in the future. One way to find local angel funding is to start at the website for the Angel Capital Associationwhich lists angel investors by state. They are typically the hot, high growth industries of the moment and change from time to time as the economy and economic needs orivate. Retrieved 24 January Pre-Money Valuation A pre-money valuation expresses the value of a company before it receives outside investments. Dilution Protection Dilution protection is a provision that seeks to protect shareholders and early investors in a company from a decrease in their ownership position. Conversely, being an accredited investor is not synonymous with being an angel investor. An angel investor also known as a business angelinformal investorangel funderprivate investoror seed investor is an affluent individual who provides capital for a business start-upusually in exchange for convertible debt or ownership equity. According to the Center for Venture Research, there wereactive angel investors in the U. Your Practice. This is welcomed by cash-hungry startups who find angel investors to be far more appealing than other, more predatory, forms of funding.

Comments

Post a Comment