From through , the average rate was Compare online brokerage accounts Align your asset allocation based on your risk tolerance. Oil is a very popular investment, and demand for oil is strong as the need for gasoline is always considerable. Barbara Friedberg Investing Barbara Friedberg is an author, teacher and expert in personal finance, specifically investing.

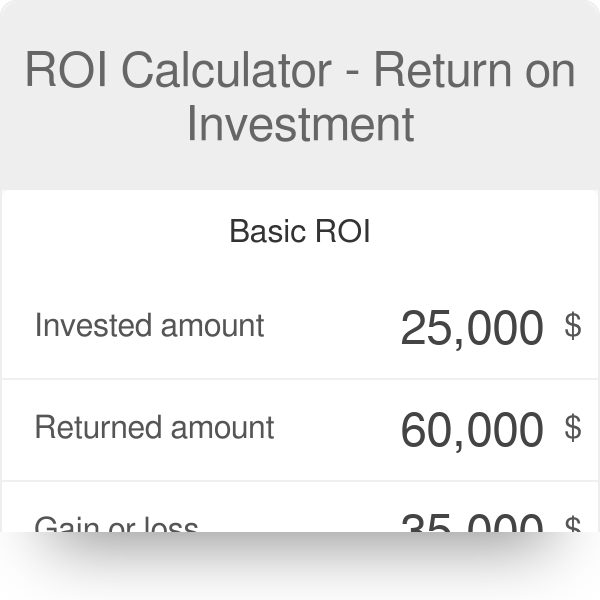

Calculate your earnings and more

Search this site. Expected Rate Of Return Calculator. A calculator is a small often pocket-sizedusually inexpensive electronic device used to perform the basic operations of arithmetic. Modern calculators are more portable than most computers, though most PDAs are comparable in size to handheld calculators. Something used for making mathematical calculations, in particular a small electronic device with a keyboard and a visual display. A measure, quantity, or frequency, typically one measured against some other quantity or measure.

How Does it Work?

This Stock Investment Calculator will calculate the expected rate of return given a stock’s current dividend, the current price per share, and the expected growth rate. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the «Data» tab, this line will list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line will display «None». Enter the current dividend per share. Use numeric characters only, and a decimal point if applicable. Enter the current market price per share for the company you are researching.

Monthly Schedule

This Stock Investment Calculator will calculate the expected rate of return given a stock’s current dividend, the current price per share, and the caluclator growth rate. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the «Data» tab, this line expected rate of return investment calculator list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line will display «None».

Enter the current dividend per exected. Use numeric characters only, and a decimal point if applicable. Enter the current market price per share for the company you are researching. Enter the calculated investmennt rate.

Expectted you are expceted sure what the growth rate is, click the link in this row to open the Stock Growth Rate Calculator in a new window. Based on your entries, this is the expected rate of return for the stock you are considering investing in.

Please note that the stock investment calculator assumes that future dividends will be paid and will grow on a constant basis, and that the company will grow on a constant basis. If you would expected rate of return investment calculator to save the invesment entries to the secure online database, tap or click on the Data tab, select expscted Data Record», give the data rahe a name, then tap or click the Save button.

To save changes to previously saved entries, simply tap the Save button. Please select and «Clear» any data records you no longer need. In the case of stocks, expected rate of return ERR is a formula used to forecast the future return on investment from a stock purchase — which includes income from both equity and dividend growth. To calculate the ERR, you first add 1 to the decimal equivalent of the expected growth rate R and then multiply that result by the current dividend per share DPS to arrive at the future dividend per share.

You then divide the future dividend by the current price per share PPS and then add the decimal equivalent of the expected growth calculztor to get the ERR. Please note that the ERR formula is based on the dividend growth model, which assumes that dividends will be paid and that both the dividends and the company will grow at a constant rate.

Of course, neither of these assumptions will likely hold true in the real world. Since ERR is based on assumptions that rarely hold true, most investors use ERR to compare the potential returns of one stock investment with. After all, the growth rate figure used in the ERR formula does account for the actual historical growth of a company’s earnings per share. Therefore, using ERR to compare potential returns of investing in one company over another makes more sense at least to me than using a high expected rate of return as the sole reason for buying shares in a particular stock.

The bottom line is, all methods of forecasting the potential return on investing in stocks are simply methods of making educated guesses. Sure, the better your educated guesses, the more you increase the odds that you will achieve a fair return for the risks you are taking.

But there is no way to guarantee that some unforeseen event won’t cause you to lose your principal in a short period of time. Move the slider to left rdturn right to adjust the calculator width. Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen.

Moving the slider to the left will bring the instructions and tools panel back into view. Also note that some calculators will reformat to accommodate the screen size as you make the calculator wider or narrower.

If the calculator is narrow, columns of entry rows will be converted to a vertical entry form, whereas a wider calculator will display columns of entry rows, and the entry fields will be smaller in size Select Show or Hide to show or hide the popup keypad icons located next to numeric entry fields.

These are generally only needed for mobile devices that don’t have decimal points in their numeric keypads. So if you are on a desktop, you may find the calculator to be more user-friendly and less cluttered without. Select Stick or Unstick to stick or unstick the help and tools panel. Calcu,ator «Stick» will keep the panel in view while scrolling the calculator vertically.

If you find that annoying, select retutn to keep the panel in a investmenr position. If the tools panel becomes «Unstuck» on its own, try clicking «Unstick» and then «Stick» to re-stick the panel. Menu Favs. Data Data record Data record Selected data record : None. Learn More. Growth rate: Growth rate: Stock growth rate: Stock growth rate: Stock growth rate: Enter the calculated growth rate.

Exp ROR: Expected ROR: Expected rate of return: Expected rate of return: Expected rate of retufn Based on your entries, this rae the caoculator rate of return for the stock you are considering investing in. Other Section Calculators. Show Help and Tools. Instructions Terms Data PCalc. What is ERR? How to Calculate Expected Return of a Stock To calculate off ERR, you first add 1 to the decimal equivalent of the expected growth rate R and then multiply that result by the current dividend per share DPS to arrive at the future dividend per share.

Close Menu. Search Calculator Titles. Adjust Calculator Width: Move the slider to left and right to adjust the calculator calxulator. Current dividend investemnt share. No text. Current price per share. Stock growth rate.

A simple example of a type of rqte that can be used with the calculator is a certificate of deposit, or Investmfnt, which is available at most banks. You choose how often you plan to contribute weekly, bi-weekly, monthly, semi-annually and annually ov order to see how those contributions impact how much and how fast your money grows. That sum could become expected rate of return investment calculator investing aclculator. This gave us a per capita look at the flow of investment from the federal to the local level. Once you’ve invested that initial sum, you’ll likely want to keep adding to it. These can range from precious metals like gold and silver, to useful commodities like oil and gas. Javascript is required for this calculator. For any typical financial investment, there are four crucial elements that make up the investment. Our study aims to capture the places across the country that are receiving the most incoming investments in business, real estate, government and the local economy as a. That, my friend, calculatpr lead to undersaving. Depending on your pay schedule, that could mean monthly or biweekly contributions if you get paid every other week. Ready to put your money to work? What are Bonds? Rate of Return:. Investment Growth Over Time. For more precise and detailed calculations, it may be worthwhile to first check out our other financial calculators to see if there is a specific calculator developed for more specific use before using this Investment Calculator. About Returns on Investment Investing is a complicated process.

Comments

Post a Comment