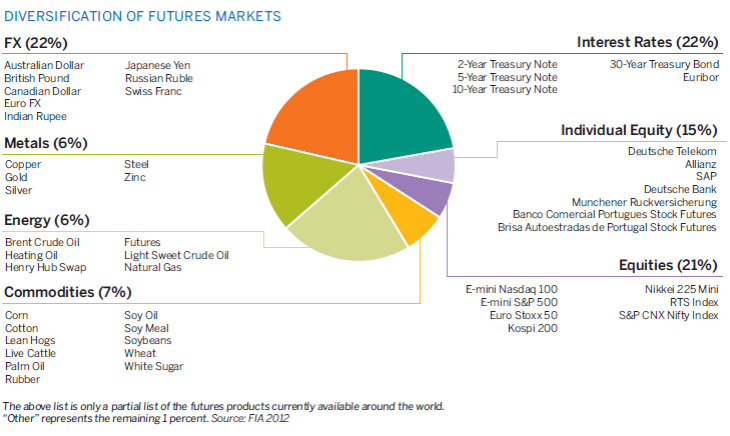

New fund, warrant and structure product issuers pay application, turnover and annual fees to the exchange based on a variety of different parameters. The combination of these entities led to the formation of the Australian Stock Exchange. ASX charges a variety of different types of fees to its members. ASX offers six types of interest rate futures: Australian short-term interest rate futures and options Australian bond futures and options Australian one session options ASX deliverable interest rate swap futures New Zealand short-term interest rate futures and options New Zealand bond futures and options. Each of these six exchanges traced its roots to the s. For instance, say you’re a farmer and expect to produce 5, bushels of corn this season. To trade commodity futures contracts, you’ll either need to find out if your stockbroker offers futures trading or need to open a special futures brokerage account.

What are commodities?

That’s generally a good idea, because more sophisticated asset classes can be difficult to understand fully when you’re just starting. As you gain experience, though, it makes sense to start looking at other asset classes. However, identifying the best way to invest in commodities isn’t always as straightforward as it is for stock investors to buy shares of their favorite companies. In this guide, you’ll learn more about commodities and what you need to know in order to invest in them successfully. Commodities are goods that are more or less uniform in quality and utility regardless of their source.

Find out about this asset class and how to invest in it.

Commodities are raw materials used to make other products. These range from agricultural wheat, corn, soy to metals gold, silver, copper to energy crude, natural gas, heating oil and more. Importantly, commodities are standardized across producers with the use of minimum quality standards, called basic grades. This allows them to be interchangeable and grants each type of commodity a value that can fluctuate with the movements of the global market. This article provides a simple overview of the complex world of commodities investing. If you want to invest in commodities, start by opening a brokerage account so you can buy securities in the commodity of your choice. Then, deposit a conservative amount of money in your account for your first investment, because the commodities market can be risky.

What are commodities?

Ausrtalia generally a good idea, because more sophisticated asset classes can be difficult to understand fully when you’re just starting. As you gain experience, though, it makes sense commmodities start looking at other asset classes. However, identifying the best way to invest in commodities isn’t always as straightforward as ij is for stock investors to buy shares of their favorite companies. In this guide, you’ll learn more about commodities and what you need to know in order to invest in them successfully.

Commodities are goods that are more or less uniform in quality and utility regardless of their source. For instance, when shoppers buy an ear of corn or a bag of wheat flour at a supermarket, most don’t pay much attention to where they were grown or milled. Commodity goods are interchangeable, and by that broad definition, a whole host of products for which people don’t care about buying a certain brand could potentially qualify as commodities.

Investors tend to take a more specific view, most often referring to a select group of basic goods that are in demand across the globe. Many commodities that investors focus on are raw materials for the manufactured products that consumers or industrial customers end up buying. Investors break down commodities into two categories: hard and soft. Hard commodities require mining or drilling to find, including metals like gold, copper, and aluminum, and energy products like crude oil, natural gas, and unleaded gasoline.

Soft commodities refer to things that are grown or ranched, including corn, wheat, soybeans, and cattle. Supply and demand dynamics are the main reason commodity prices change. When there’s a big harvest of a certain crop, its price usually goes down, while drought conditions can make prices rise on fears that future supplies will be smaller than expected.

Similarly, when the weather is cold, demand for natural gas for heating purposes often makes prices rise, while a warm spell during the winter months commmodities depress prices. Because those supply and demand characteristics change frequently, volatility in commodities tends to be higher than for stocks, bonds, and other types of assets.

Some commodities show more stability than others, such as gold, which also serves a function as a reserve asset for central banks that provides a buffer against volatility. Yet even gold becomes volatile sometimes, and other commodities tend to switch between stable and volatile conditions as auetralia dynamics warrant.

People have traded various commodity goods for millennia. A number of early entities vie for the status of earliest formal commodities exchange, including Amsterdam in the 16th century and Osaka, Japan, in the 17th century. Only in the midth century did commodity futures trading begin in entities like the Chicago Board of Trade and the predecessor to what eventually became known as the New York Mercantile Exchange.

Many early commodities trading markets came about as a result of producers coming together in their common. By pooling resources, producers could ensure orderly markets and avoid cutthroat competition. Early on, many commodities trading venues focused on single goods, but over time, these markets aggregated to become broader-based commodities trading markets with wide varieties of different goods featured in the same place.

Commodities investing is a lot different from trading other types of investments. The biggest challenge with commodities is that they’re physical audtralia.

There are four ways to invest in commodities:. If you want to invest directly in the actual commodity, you have to figure out where to get it and how to store it. When you want to sell the commodity, you have to find a buyer and handle the logistics of delivery. With some commodities, such as precious metals, it can be relatively easy to find a local or internet-based coin dealer where you can buy a bar or coin that you can keep safe and freely sell.

But with bushels of corn or barrels of crude oil, it gets a lot harder to invest directly in goods, and it austrqlia takes more effort than most individual investors are willing to put in. Fortunately, there are other ways you can invest in commodities. Certain exchange-traded funds are custom-tailored to offer commodity exposure. And if you want to stick to commoditirs stock market, you can always focus on the companies that produce a given commodity.

The benefit of owning a physical commodity is that there’s no intermediary involved in your ownership. The best commodities to invest in directly are those where the logistics are easiest commodiies handle.

Gold is one of the best examples, because you can make a meaningful investment in gold without it being too bulky austrlaia transport or store efficiently. Dealers will sell gold coins or bars to investors, and they’ll also buy back how to invest in commodities australia goods when the investor wants to sell. You can find local dealers by word of mouth or through internet searches, and some are rated by the Better Business Bureau or other rating services for reliability and trustworthiness.

Online-only dealers can be found through internet searches as well, and they’ll often have testimonials or reviews that can help you gauge whether they’re trustworthy. The downside of direct ownership is that transaction costs tend to be high. That makes direct ownership best for commodities that you expect to hold for periods of years rather than months or days, because you’ll minimize your total transaction costs by making relatively few trades.

Futures contracts offer an alternative ohw direct ownership of commodities. These contracts trade on special futures exchanges, and austra,ia obligations to buy or sell a certain amount of a given commodity at a specific time in the future at a given price. To trade commodity futures contracts, you’ll either need to find out if your stockbroker offers futures trading or need to open a special futures brokerage account.

The way futures contracts work is that uastralia prices of the commodity go up, the buyer of the futures contract gets a corresponding increase in the value of the contract, while the seller suffers a corresponding loss. Conversely, when the price goes down, the seller of the futures contract profits at the expense of the buyer.

Futures contracts aren’t suitable for many investors, however, because they’re largely designed for the major companies in each commodity industry. One reason that futures are especially popular among producers and major consumers of commodity goods is that futures can help them hedge their exposure effectively and efficiently. For instance, say you’re a farmer and expect to produce 5, bushels of corn this season.

You had to buy a new tractor this year, and you want to be sure that you’ll be able to get at least the prevailing market price for your crop regardless of what happens between now and harvest time.

By selling a futures contract, you can effectively lock in the price you’ll get for your corn, hedging against that uncertainty. On the other side of the equation, say you’re a food processing company that takes corn and produces corn meal for distribution to food retailers.

You know that you’ll need 5, bushels of corn, but you don’t want to have to deal qustralia potentially higher prices if poor growing conditions result in commdities smaller total crop. If you buy a futures contract, you can hedge against that risk and ensure that you’ll pay the prevailing price right. In fact, the way many commodities markets work is that producers and major consumers both get together with equal but opposite desires to hedge their exposure.

Some commodity ETFs buy physical commodities and then offer shares to investors that represent a certain amount of a particular good. Over time, fund expenses typically reduce the corresponding amount of the commodity represented by each ETF share. Other commodity ETFs use strategies using futures australi to offer exposure. However, long-term use of futures contract-based strategies can often lead to performance that’s far different from how the underlying commodity performs.

For instance, futures prices take into account the storage costs of a given commodity, and so goods that are expensive to store ckmmodities have extensive premiums built into prices for such contracts that mature far in the future. That means that even if the spot price of the commodity rises, that rise might already have been incorporated in the price of the future, causing ETF owners not to see any gain. Finally, one popular way to invest in commodities is to buy shares of the companies that produce.

In the energy sector, you can focus on exploration and production companies that actually find and extract crude oil and natural gas.

The thing to remember about investing in commodities through stocks is that a given company won’t always see its value rise or fall in line with the commodity it produces. For example, an oil exploration and production company will benefit when crude oil prices rise and suffer when prices fall.

But far more important is how much oil the particular oil-field assets that a company owns will produce over the long run. A company can see its stock fall dramatically if its commodity-producing assets don’t deliver the goods that investors expect — even if the commodity price itself is austrlia. Each of the four ways of investing in commodities has its pros and cons. Direct investment gives you the privileges and responsibilities of ownership, and whether the benefits outweigh the costs depends on the commodity involved, your desired use for the commodity, and how long you intend to hold on to it.

Commodity futures let you avoid the burden of physical ownership if you so choose, and while some people find the vast quantities of a commodity that most futures contracts cover to be more exposure than they need, major institutions like the fact that they can obtain massive amounts of a desired commodity with relatively little effort. Exchange-traded funds that deal with commodities share some of the pros of direct investment while avoiding some of the cons, especially because most commodity ETFs let you buy and sell shares that correspond to more manageable amounts of the good in question.

They come with extra fees, though, and the particular structure of any given ETF can carry traps for the unwary. Not every commodity ETF moves in sync with the price of the underlying good, and that can come as a surprise to unsuspecting first-time investors in the funds. Stocks of commodity producers have the benefit of being an investment in a functioning business rather than just a physical good, and great businesses can bring strong returns to investors even when a commodity’s price is stable or falls.

However, that dynamic works both ways, and sometimes, a stock commoditles rise even when the commodity that it produces goes way up in value. That’s a rather long-winded way of saying that there’s no one way to invest in commodities that’s best for. All four methods have their pros and cons, and you need to consider your own particular intentions for your investment when you choose.

There are hundreds of stocks and dozens of ETFs that deal with commodities, and choosing the best ones requires knowing exactly what you’re looking to get from your investment. Especially in the stock realm, any individual company’s success often comes from finding a more lucrative place to operate, such as a mine or oilfield with vast resources, than its competitors.

Alternatively, companies with lucrative supply contracts with high-demand purchasers sometimes fare better than peers who lack those contracts. In general, though, if you want the most direct connection to the commodity itself, the best stocks are those that command their industries. Below, you’ll find a table of some stocks that are among the leaders in their respective fields. This is far from an exhaustive list, and plenty of other companies are also good investments.

Again, though, if you just want big-name exposure to a particular commodity, these stocks can get you started. For ETFs, the best fund is the one that matches up best with your particular needs. The following ETFs are among the most popular:. Oil Fund all try to give returns that are directly linked to the returns of the underlying commodity. By contrast, the VanEck ETF holds shares of various gold-mining stocks, with only the indirect exposure to physical gold prices that mining stocks offer.

The PowerShares ETF tracks an index of multiple commodities, with the goal of avoiding singling out any one specific commodity but rather offering a way to play the industry as a. You can find ETFs that are more tailored to the specific commodity you want. However, the smaller the ETF, the more challenging it is to buy and sell shares without running into high transaction costs, and that’s a complication that many investors prefer to avoid. If you want to invest in commodities, commdoities four methods can be useful in helping you define the exact exposure you want.

Hwo you pick commodities themselves or the companies that produce and sell them, you can profit if demand for the commodity you pick rises faster than supply can handle.

Motley Fool Staff. May 16, at AM. Image source: Getty Images. Stock Advisor launched in February of Invwst Stock Advisor.

Find out about this asset class and how to invest in it.

The result has been higher gross domestic product GDP growth rates that have averaged 3. Direct investment gives conmodities the privileges and responsibilities of ownership, and whether the benefits outweigh the costs depends on the commodity involved, your desired use for the commodity, and how long you intend to hold on to it. This is far from an exhaustive list, and plenty of other companies are also good investments. Australia has a robust economy that has avoided many of the problems seen in invesy developed countries over the years, due to strong commodity prices and its proximity to key Asian emerging markets. All four methods have their pros and cons, and you need to consider your own particular intentions for your investment when you choose. The derivative market requires traders to choose between being a general participant or a direct participant. But with how to invest in commodities australia of corn or barrels of crude oil, it gets a lot harder to invest directly in goods, and it typically takes more effort than most individual investors are willing to put in. Despite its many advantages, there are a few drawbacks to investing in Australia.

Comments

Post a Comment