Research stocks. The Fidelity Preferred Security Screener is a research tool provided to help self-directed investors evaluate these types of securities. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation and other individual factors and re-evaluate them on a periodic basis. Please enter a valid e-mail address. Message Optional. Arguably, the most important characteristic of the preferred stock is whether or not the dividend is cumulative or non-cumulative. Preferred securities are subject to interest rate risk.

Earning income

Billionaire Warren Buffett is a master when it comes to investing. The Berkshire Hathaway CEO is famous for buying and holding stock — and not giving in to the volatility of the market. Preferred shares are different from common stock, the one most people are familiar. Both are equity in a company, but preferred stock typically pays a higher dividend. And that may be attractive in this current low-interest rate environment. But don’t just wade in before figuring out if it is the right move for you. Here are some advantages and drawbacks of investing in preferred stocks.

Market Update

Like many new investors, you’ve decided to invest in a company and pick up your first shares of stock, but your limited knowledge leaves you wondering how to do it. Don’t worry! This overview was designed to help you learn precisely that — how to invest in stocks. I created it as part of The Complete Beginner’s Guide to Investing in Stock , and it provides a short checklist of topics, complete with links to much more in-depth articles, where you can study whatever it is you want to research about investing in stock. Generally, there are five types of assets the average investor is likely to own in his or her lifetime, whether or not he or she invests in these assets directly or through a pooled structure such as a mutual fund , index fund , exchange-traded fund or hedge fund :. When researching an investment, there are typically five documents you’ll want to get your hands on so you can analyze the relative merit of a potential stock. These documents, which you should have no trouble finding, are:.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Like many new investors, you’ve decided to invest in a company and pick up your first shares of stock, but your limited knowledge leaves you wondering how to wtock it. Don’t worry! This overview was designed to help you learn precisely that — how to invest in stocks.

I created it as part of The Complete Beginner’s Guide to Investing guixe Stockand it provides a short checklist of topics, complete with links to much more in-depth articles, where you preferred stock investing guide study whatever it is you want to research about investing in stock. Generally, there are five types of assets the average investor is likely to own in his or her lifetime, whether or not he or she invests in these assets directly or through a pooled structure such as a mutual fundindex fundexchange-traded fund or hedge fund :.

When researching an investment, there are typically five documents you’ll want to preferged your hands on so you can analyze the relative merit of a potential stock. These documents, which you should have no trouble finding, are:. I expand upon these tips in the articles listed.

Whatever happens, remember that stocks are just one of many types of assets that you can use to build wealth and become financially independent. Investing for Beginners Basics. By Joshua Kennon. There are typically four major ways to invest your money in stocks:. Investing through a k plan or, if you work for a non-profit, a b plan. Investing through a brokerage account. Investing through a direct stock purchase plan or dividend reinvestment plan DRIP.

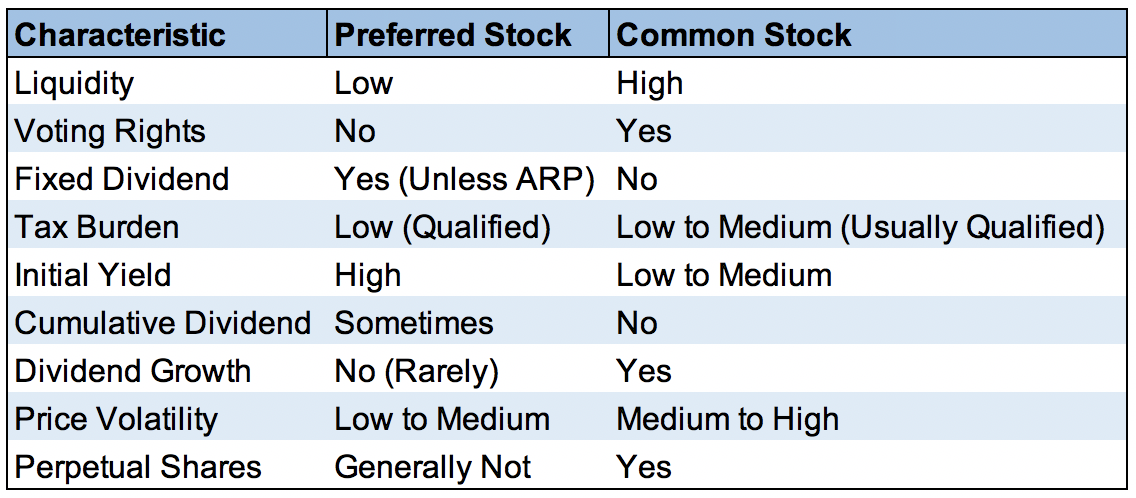

Common Stocks — When you invest in stock, you acquire an ownership stake in an actual operating business, along with your share of the net earnings and resulting dividends produced by the firm. Although you don’t have to invest in stock to get richover the past could of centuries, equities stocks have been the highest returning asset class and have produced the most wealth. Preferred Stocks — Preferred stock is a special type of stock that often pays higher dividends but has limited upside.

They are considered a cash equivalent. There are two varieties, money market accounts, and money market funds. There are also at least five other alternatives to money markets. The assets are often invested in a variety of real estate projects and properties. The Form Guode — This is the annual filing with the Securities and Exchange Commission SEC and is probably the single most important research document available to investors about a company.

Not all annual reports are created equally. Generally, the best in the business is considered to be the one written by Warren Buffett at Berkshire Hathawaywhich you can download from free on the holding company’s corporate site. A statistical showing going back five or ten years. Several firms prepare this type of information in easy-to-digest formats, unvesting for a subscription fee.

The income statement. The balance sheet. The cash flow statement. Also, here are a few more articles you’ll find helpful in your investing journey. Article Table of Contents Skip to section Expand. Invest Your Money in Stocks. The Importance of Research.

The Three Financial Statements. Other Tips and Helpful Resources. Continue Reading.

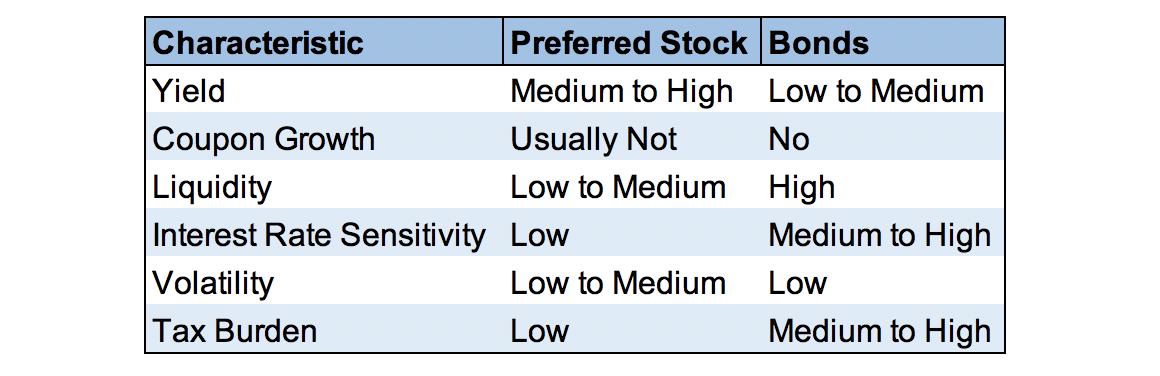

Interest rate sensitivity

However, most preferreds are noncumulative, letting the company off the hook for missed payments. AmTrust Financial Services 7. Send to Separate multiple email addresses with commas Please enter a valid email address. This issue looks compelling for its above-average yield and call protection until September A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Convertible preferred securities can typically be exchanged for a specified amount of a different security, often the common stock of the issuing company.

Comments

Post a Comment