For example, if your income is less stable, you might want to have a lower stock allocation. Yes, was a bad year. Now, the savings goals.

Investment Calculator

With the new year finally upon us, you may be aching to make some significant changes in your life. Maybe you want to start exercising more often and taking better care of your health. Or, perhaps you want to spend more quality time with your kids — time where you only focus on them and nothing. But, where should you invest your money? This question plagues both beginning investors and established pros.

How to Invest Your $50,000

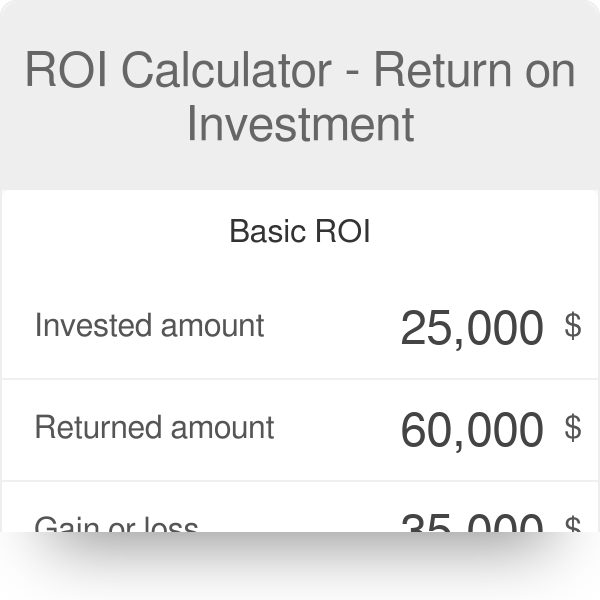

Our investment calculator tool shows how much the money you invest will grow over time. We use a fixed rate of return. To better personalize the results, you can make additional contributions beyond the initial balance. You choose how often you plan to contribute weekly, bi-weekly, monthly, semi-annually and annually in order to see how those contributions impact how much and how fast your money grows. When we make our calculations, we also factor in compounding interest, showing how the interest you earn can then earn interest of its own. Barbara Friedberg is an author, teacher and expert in personal finance, specifically investing. For nearly two decades she worked as an investment portfolio manager and chief financial officer for a real estate holding company.

What Investing Does

Ear show you a new way to accelerate your wealth building. With the stock market, you can lose money over a short period of time. Is this too risky? Once you open an account, you can invest in what you could earn investing 40000 metro markets like Los Angeles, Washington D. Try Personal Capital. Interest earned on bonds is taxed, as are any capital gains. You can set multiple goals, or just one. The bottom line: Money saved in an HSA has a triple tax advantage! For example, minus your age has become something closer to the new standard. Because when you invest cash instead of spending on depreciating assets, you set yourself up to have more financial freedom and better outcomes later on. All Rights Reserved. It canof course. At the end of the term, assets are returned to existing shareholders.

Comments

Post a Comment