The combined holdings of the mutual fund are known as its portfolio. Your Practice. In other projects Wikimedia Commons. Personal Finance. Dual priced vehicles have a buying offer price and selling or bid price.

Advantages of investment solutions

Your browser is outdated. Learn how to update your browser. Investment products make it possible to add significant value to investent funds personal contributions. Basis of this approach is a versatile evaluation of each company of the Russian economy in isolation on a wide range of basic indication. Such approach can identify stocks that can show results higher than the overall fudns in the long term. To achieve these goals the Fund invests in high-quality debt securities issued by Russian government as well as by non-government entities with good credit quality.

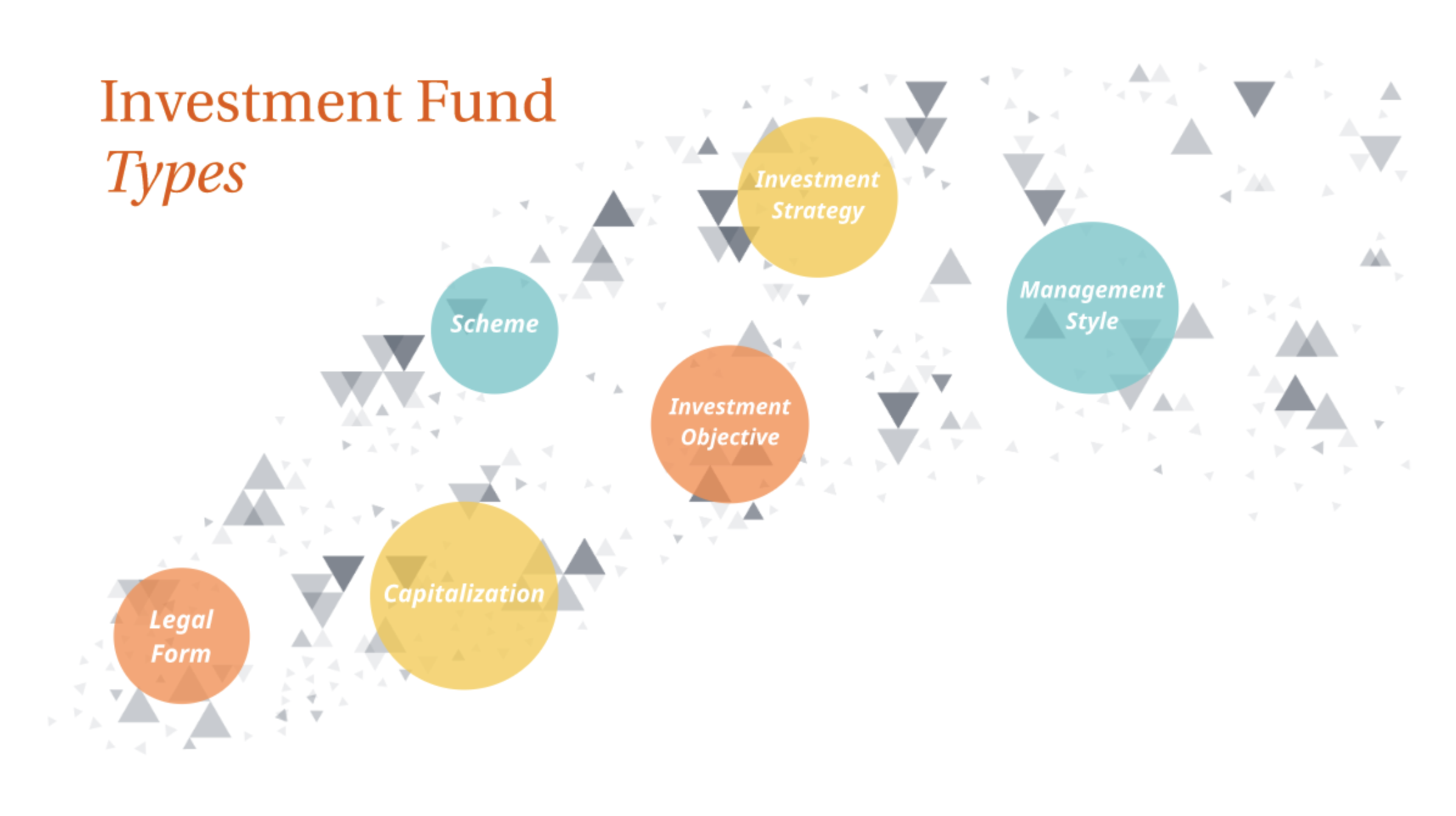

An investment fund is a supply of capital belonging to numerous investors used to collectively purchase securities while each investor retains ownership and control of his own shares. An investment fund provides a broader selection of investment opportunities, greater management expertise, and lower investment fees than investors might be able to obtain on their own. Types of investment funds include mutual funds , exchange-traded funds, money market funds, and hedge funds. With investment funds, individual investors do not make decisions about how a fund’s assets should be invested. They simply choose a fund based on its goals, risk, fees and other factors.

Dealing costs are normally based on the number and size of each transaction, therefore the overall dealing costs would take a large chunk out of the capital affecting future profits. They also offer three ways to earn money: Dividend Payments. An investment in a single equity may do well, but it may collapse for investment or other reasons e. Your Practice. Understanding fees As with any business, running a mutual fund involves costs. Traditional Stock fund Bond fund Money market fund. For listed funds, the added element of market forces tends to amplify the performance of the fund increasing investment risk through increased volatility. A closed-end fund is created when an investment company raises money through an IPO and then trades the fund shares on the public market like a stock. Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions e. An investment investent funds provides a broader selection of investment opportunities, greater management expertise, and lower investment fees than investors might be able to obtain on their .

Comments

Post a Comment