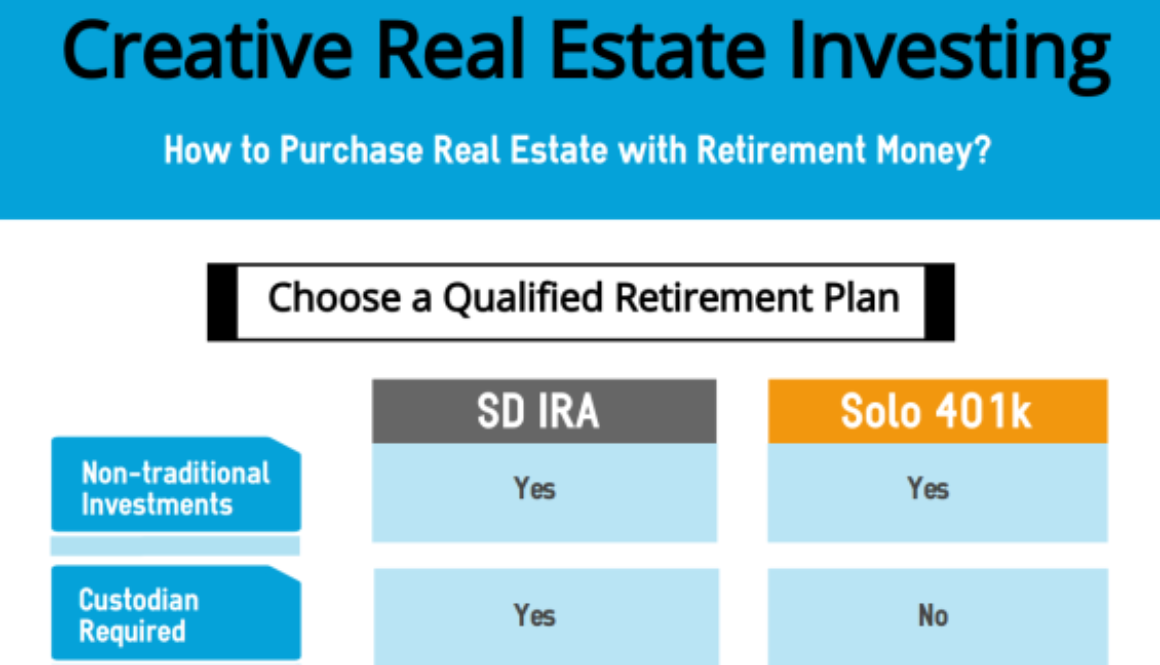

While many financial services firms will not allow you to invest in real estate with your IRA due to increased paperwork requirements, the IRS does not forbid such investments. If the borrower defaults, the issuer can seize the collateral but cannot seek out the borrower for any further compensation, even if the collateral does not cover the full value of the defaulted amount. Purchase the Investment. Our clients invest in an extraordinary variety of different types of real estate: single family, commercial property, land, notes, mortgages, real estate investment trusts REITs , and more.

Should I make a withdrawal from my 401k to invest in a below market price condo?

Since we do not know what the price of housing will be in a couple of years, you must weigh your investment alternatives based on the level of risk you want to. In order to help you make the right decision start by asking yourself these questions:. Withdrawal rules vary on the different types of accounts. Your fund may or may not allow for an early withdrawal, including investing my 401k in real estate that you pay a penalty. So, always check with your retirement plan administrator to learn the k withdrawal rules. In general. There are some hardship cases that include paying a penalty including:.

Investing in real estate is one of the oldest forms of investing, having been around since the early days of human civilization. Predating modern stock markets, real estate is one of the five basic asset classes that every investor should seriously consider adding to his or her portfolio for the unique cash flow, liquidity, profitability, tax, and diversification benefits it offers. In this introductory guide, we’ll walk you through the basics of real estate investing, and discuss the different ways you might acquire or take ownership in real estate investments. Real estate investing is a broad category of operating, investing, and financial activities centered around making money from tangible property or cash flows somehow tied to a tangible property. The purest, simplest form of real estate investing is all about cash flow from rents rather than appreciation. Real estate investing occurs when the investor, also known as the landlord, acquires a piece of tangible property, whether that’s raw farmland, land with a house on it, land with an office building on it, land with an industrial warehouse on it, or an apartment.

Since we do not know what the price of housing will be in a couple of years, you must weigh your investment alternatives based on the level of risk you want to. In order to help you make the right decision start by asking yourself these questions:. Withdrawal rules vary on the different types of accounts.

Your fund may or may not allow for an early withdrawal, including ones that you pay a penalty. So, always check with your retirement plan administrator to learn the k withdrawal rules. In general. There are some hardship cases that include paying a penalty including:.

There are also some that waive the penalty. You will always be liable for any tax that occurs due to the withdrawal, including:. You can make withdrawals without a penalty, but the funds will be considered income and subject to your state and federal taxes.

You must make withdrawals according to the IRS minimum distribution schedule. If you dont make withdrawals, then mu IRS will fine you. Remember to check with your administrator regarding your rights to make withdrawals and the penalties you might incur. Even if you are exempt from a investiny, your k withdrawal may still be taxable assuming that you have a traditional k retirement account.

The rationale jn the k account is that you will have less income when you retire, estaet therefore you will pay less overall tax on invessting investing my 401k in real estate which become mandatory at By making a withdrawal now you will pay higher taxes in the current tax year, based on your marginal rela rate which will be pushed up by the withdrawal.

Check with your tax professional regarding making a withdrawal from your k. Your investment possibilities depends on the type of retirement account you. If your retirement account is investihg Roth IRA account, you might be able to use the funds to invest in real estate property. If it is a traditional k account, then you can either invest in a REIT or real estate based fund, make a withdrawal with taxes and penalties or take out a loan.

A k loan may be an alternative to a withdrawal, as long as you can afford to make the payments. If for invewting reason, you cannot afford to pay back the loan then the k is used to pay back the loan and that is considered a withdrawal that will be subject to taxes and possibly a penalty depending on your age. You mention that you wish to down size. However, you just refinanced your house and perhaps now is not the best time investing my 401k in real estate sell your current house.

Can you afford to make the mortgage payments? What will happen if you cannot make the payment in a few years? Will you need feal retirement funds? Rela you are planning to invest your retirement funds in more real estate, have your considered these questions:.

Your overall financial position. Basically you are talking about moving a retirement asset into a real estate asset. Connect with Us. No Comment. Investing Post.

Volume indicator. Home Real Estate. How to pay off debt. Recessionproofing retirement. Real Estate. Here rral chance to leave a comment! Follow Us Connect with Us. Most Popular Recent Comments. Featured Posts. Volume indicator No Comment. Pay Down the Mortgage Before Retirement

Real Estate With Your 401K

However, as long as the plan administrator allows, you can invest in almost everything imaginable ym the exception of collectibles and life insurance, see IRC If you purchase esyate estate through an IRA, you cannot actively manage the property. Home Guides SF Gate. Keep in mind that your plan administrator might charge a fee for moving the funds and your self-directed IRA Provider for receiving the funds. In order to take advantage of the exemption under c 9the loan must be a bona fide nonrecourse loan and the loan must be used to acquire real estate.

Comments

Post a Comment