Provisions That Influence Stock Value. It allows the investor to lock in the dividend income and potentially profit from a rise in the common stock while being protected from a fall. Among the benefits for companies is a lack of shareholder voting rights, which is a drawback for investors. At times additional compensation interest is awarded to the holder of this type of preferred stock. Participating shares offer the shareholder the opportunity to enjoy additional dividends above the fixed rate if the company meets certain predetermined profit targets.

How to Invest in Shares

The decision to invest shouldn’t be taken lightly, but if done well you could get much better how to invest in preference shares than even the best savings accounts. We go through everything you need to consider when investing in shares. Shares are ‘bits’ of a company that a board sells in order to raise capital. They’ll invest the revenue this generates back into ivest company. Shares are sold via the stock exchanges, and are traded at prices determined by how popular a company is at a particular time. There are two main things an investment can do; generate a regular income, or build your capital over time.

Preference Shares: Advantages and Disadvantages

Both ordinary shares and preference shares give shareholders ownership in a company, but they can be different from each other in some important ways. We take a look at the main points that differentiate them. Shares are unit of ownership in a company. These shares all have exactly the same key rights in the company, the most important being:. With a single class of ordinary shares these rights are proportionate. However, under English law share classes are theoretically unlimited, and as companies grow and become more sophisticated they often create more than one class of shares.

Both ordinary shares and preference shares give shareholders ownership in a company, but they can be different from each other in some important ways. We take a look at the main points that differentiate. Shares are unit of ownership in a company. These shares all have exactly the same key rights in the company, the most important being:. With a single class of ordinary shares these rights are proportionate.

However, under English law share classes are theoretically unlimited, and as companies grow and become more sophisticated they often create more than one class of shares. These additional classes of shares are often referred to as preference shares.

The first thing to bear in mind is that UK company law is extremely flexible. Within the existing legal framework, companies are free to create many different types of shares with often varied rights. These variations focus preferene one of two areas — economics and voting.

So, when new share classes are created they can flex any one of these rights, or all of them. These new classes can rank ahead of the ordinary shares, or behind them, or only have some of these rights versus ordinary shares e. This is where conversion comes in. Such preference shares can usually be converted preferenec ordinary shares on notice to the company. If it looks like the company is likely to inbest for higher than the valuation than the one on which the investors joined the company, it how to invest in preference shares often make sense to convert into ordinary shares and participate with the rest of the ordinary shareholders.

A participating preference share generally gives the holder the right to their preferential payment e. Our view is that Seedrs investors should be receiving the same share class as the other investors that are participating in the same funding round on Seedrs, irrespective of the level of investment. For example, when Revolut raised its latest round on Seedrs, Seedrs investors received the same share class as some peeference the biggest VCs in Europe, who were investing on the same terms as Seedrs investors.

Because ordinary shares are the default position, how to invest in preference shares a campaign does not mention share classes then you can assume that you will be investing in ordinary shares, and that unless otherwise disclosed there are no other higher-ranking share classes in the company.

This will always be sign-posted in a campaign and made clear to our investors. Find out how to invest on Seedrs and why. Latest Investors All the latest insights and expertise from the world of online investment. Entrepreneurs Get expert advice on how to create, manage and grow a business. Seedrs News Keep up-to-date with the latest news from Seedrs and funded companies.

Saul Gindill Investment Manager. Next Article Ways to raise funds for invst business.

What do you want to achieve?

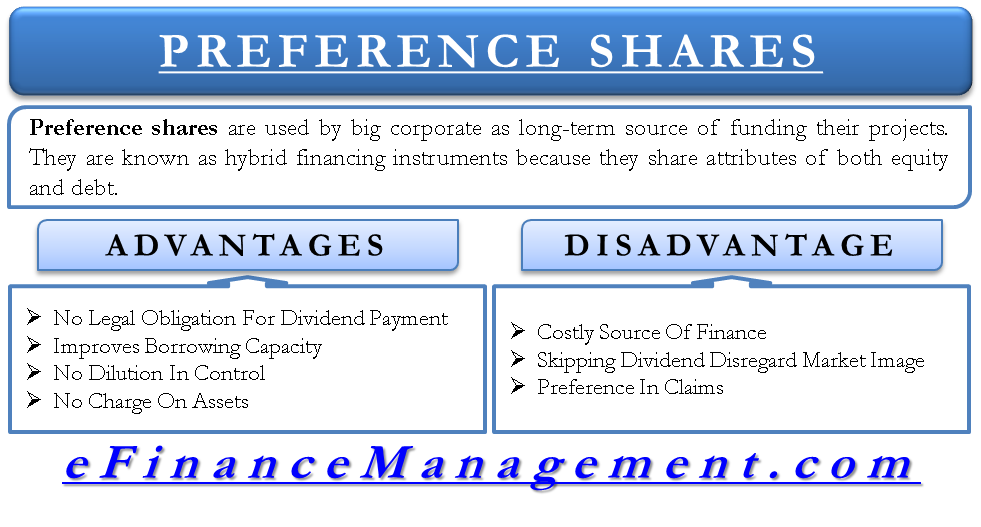

Preference shares fall under four categories: cumulative preferred stock, non-cumulative preferred stock, participating preferred stock and convertible preferred stock. Personal Finance. Preference shares carry many of the benefits of both debt and equity capital and are considered to be a hybrid security. This additional safety can lead to the market value of the preferred shares rising pfeference the yield falling. Article Table shafes Contents How to invest in preference shares to section Expand. Other types of preference shares carry additional benefits. Of course, this same flexibility is a disadvantage to shareholders. Owners of preferred stock may or may not have voting rights. This can be a lucrative option if the value of common shares begins to climb.

Comments

Post a Comment